Trinseo PLC's (NYSE:TSE) investors are due to receive a payment of $0.01 per share on 24th of April. Including this payment, the dividend yield on the stock will be 0.8%, which is a modest boost for shareholders' returns.

See our latest analysis for Trinseo

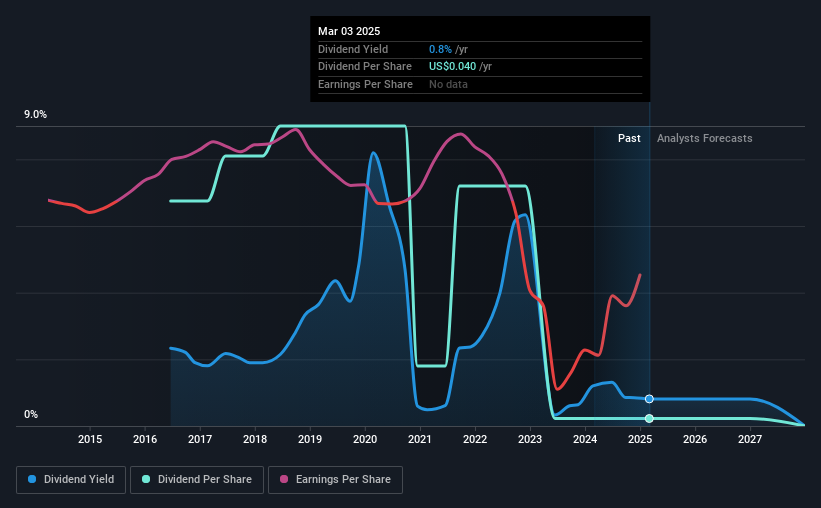

Trinseo's Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Even though Trinseo is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Looking forward, earnings per share could 55.8% over the next year if the trend of the last few years can't be broken. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

Trinseo's Dividend Has Lacked Consistency

Looking back, Trinseo's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2016, the annual payment back then was $1.20, compared to the most recent full-year payment of $0.04. The dividend has fallen 97% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Earnings per share has been sinking by 56% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of Trinseo's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 4 warning signs for Trinseo you should be aware of, and 3 of them are concerning. Is Trinseo not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.