Over the last 7 days, the United States market has experienced a slight drop of 1.3%, yet it remains up by an impressive 15% over the past year, with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying promising stocks involves looking beyond short-term fluctuations to find companies with strong fundamentals and growth potential that are not yet widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association offering a range of banking products and services in the United States with a market cap of $1.85 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer and Commercial segments, contributing $436.11 million and $255.25 million, respectively. The company's net profit margin is not disclosed in the provided information.

Pathward Financial, with total assets of US$7.6 billion and equity of US$776.4 million, stands out in the banking sector for its strategic moves and robust financial health. Total deposits amount to US$6.5 billion, while loans are at US$4.5 billion, complemented by a net interest margin of 6.4%. The company has a sufficient allowance for bad loans at 0.8% of total loans, indicating prudent risk management practices. Recently repurchasing 701,860 shares for US$51.97 million shows confidence in its value proposition amidst trading at 52% below fair value estimates and earnings growth surpassing industry averages by 5%.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Value Rating: ★★★★★★

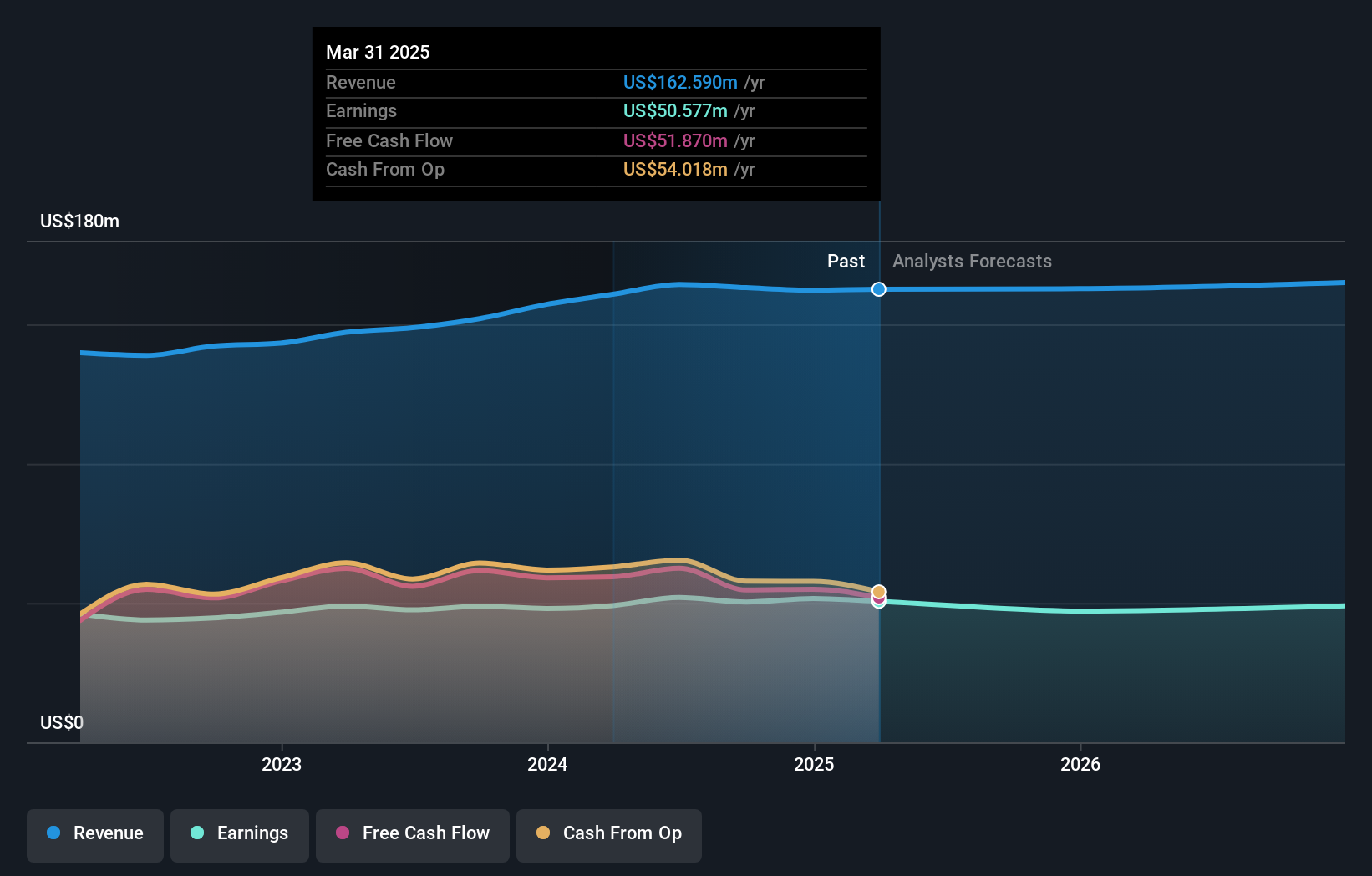

Overview: First Community Bankshares, Inc. is a financial holding company for First Community Bank, offering a range of banking products and services with a market cap of $768.42 million.

Operations: With a revenue of $162.26 million from its community banking segment, First Community Bankshares focuses on providing various banking products and services.

First Community Bankshares, a smaller financial entity, boasts total assets of US$3.3 billion and equity of US$526.4 million. It holds deposits totaling US$2.7 billion against loans of US$2.4 billion, with a net interest margin standing at 4.4%. The bank's allowance for bad loans is quite robust at 173%, while non-performing loans are low at 0.8% of total loans, indicating sound risk management practices. Despite earnings forecasted to dip by an average of 3.5% annually over the next three years, recent growth outpaced the industry with a 7.5% increase in earnings last year compared to the sector's -2.1%.

Bristow Group (NYSE:VTOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bristow Group Inc. offers vertical flight solutions and has a market capitalization of approximately $1.06 billion.

Operations: Bristow Group generates revenue primarily through its vertical flight solutions. The company's net profit margin has shown variability, reaching different levels across reported periods.

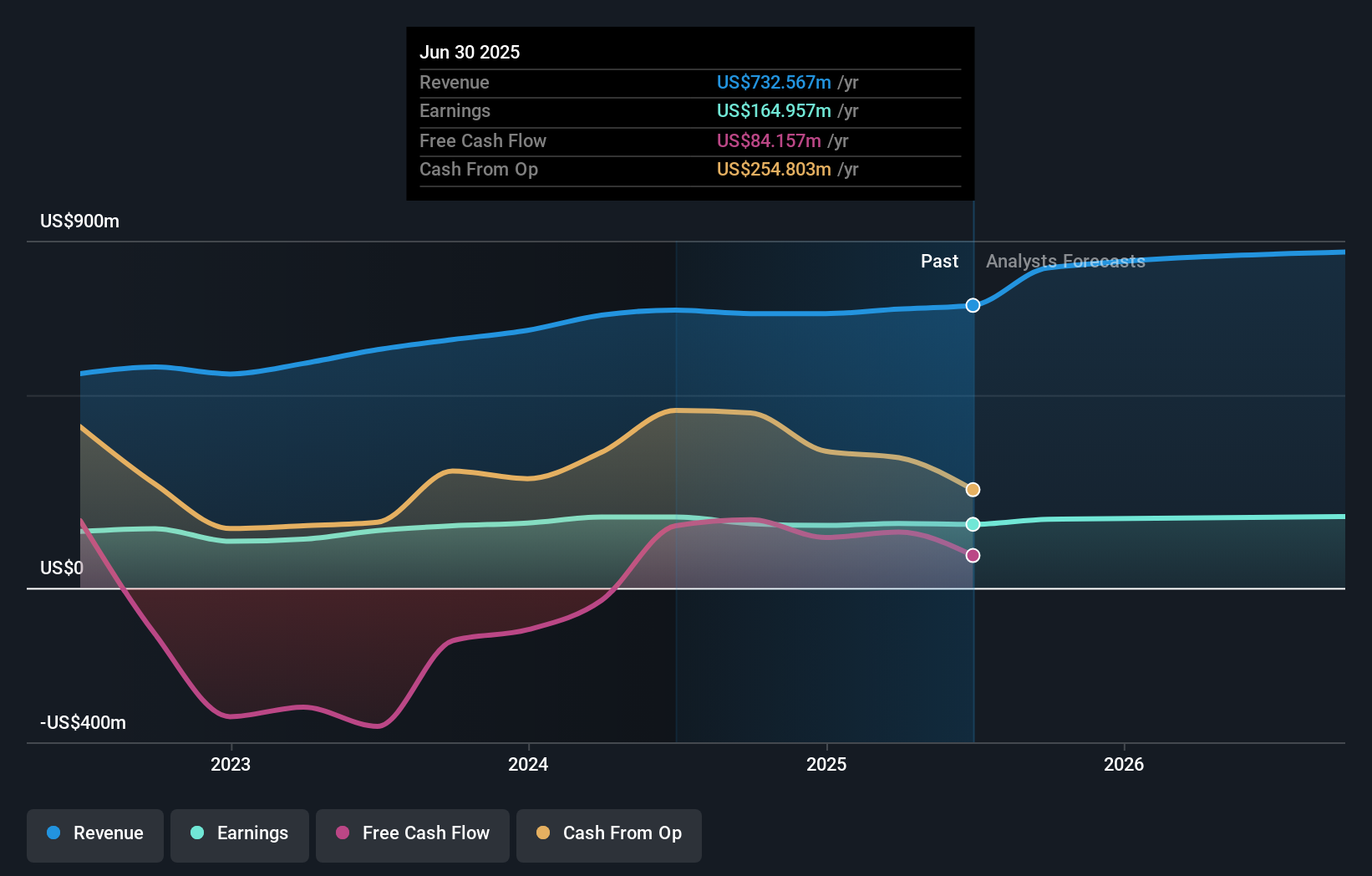

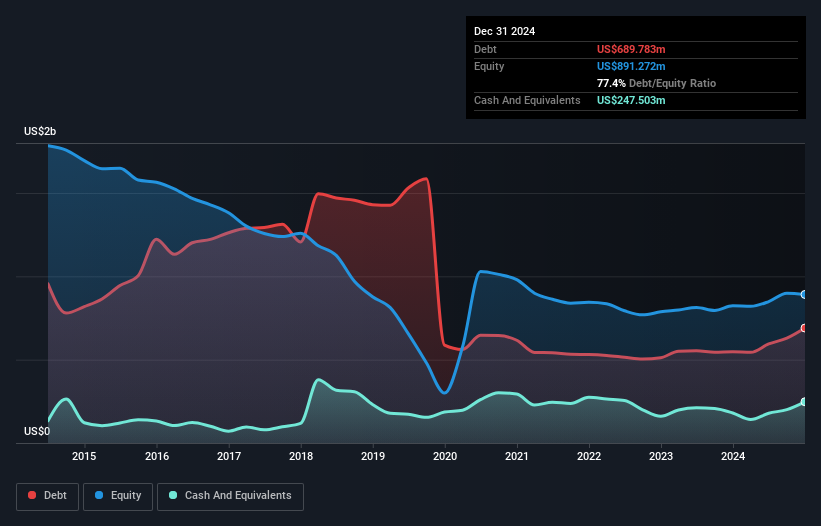

Bristow Group, a player in the offshore helicopter market, has shown promising financial strides. With net income reaching US$94.8 million from a previous loss of US$6.78 million, the company is on an upward trajectory. The net debt to equity ratio stands at 49.6%, which is considered high but manageable given their EBIT covers interest payments 5.1 times over. Trading at 76% below its estimated fair value and with earnings expected to grow by 15% annually, Bristow's strategic share repurchase plan of up to US$125 million further underscores its commitment to enhancing shareholder value amidst rising demand in energy services.

Make It Happen

- Click here to access our complete index of 285 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com