Top 3 Industrials Stocks That May Rocket Higher This Month

Benzinga · 03/14 10:29

Share

Listen to the news

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

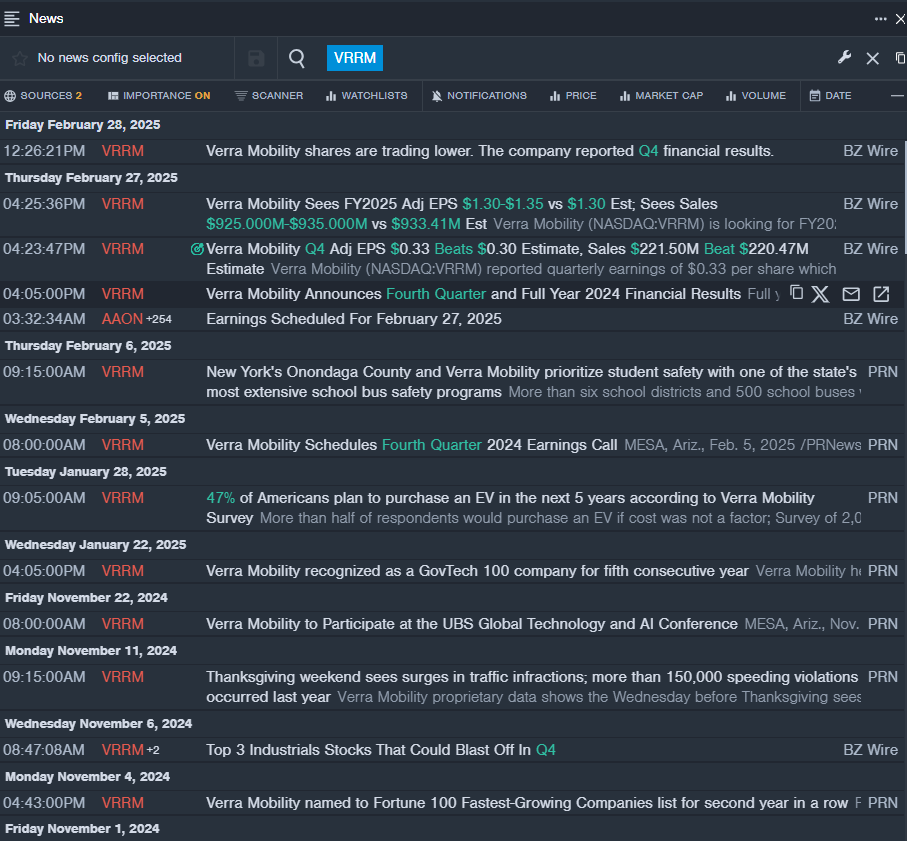

Verra Mobility Corp (NASDAQ:VRRM)

- On Feb. 27, Verra Mobility posted better-than-expected quarterly results. “We delivered a solid fourth quarter, highlighted by strong earnings and cash flow generation,” said David Roberts, President and CEO, Verra Mobility. The company's stock fell around 23% over the past month and has a 52-week low of $19.51.

- RSI Value: 26.5

- VRRM Price Action: Shares of Verra Mobility gained 2.2% to close at $20.20 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest VRRM news.

AeroVironment, Inc. (NASDAQ:AVAV)

- On March 4, AeroVironment reported worse-than-expected third-quarter financial results and issued FY25 guidance below estimates. “We faced a number of short-term challenges in the third quarter, including the unprecedented high winds and fires in Southern California, which impacted our ability to meet our goals,” said Wahid Nawabi, AeroVironment chairman, president and chief executive officer. “Nevertheless, we made significant progress towards executing our long-term growth strategy and building resiliency for the future." The company's stock fell around 21% over the past month and has a 52-week low of $110.07.

- RSI Value: 28

- AVAV Price Action: Shares of AeroVironment gained 2% to close at $123.99 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in AVAV stock.

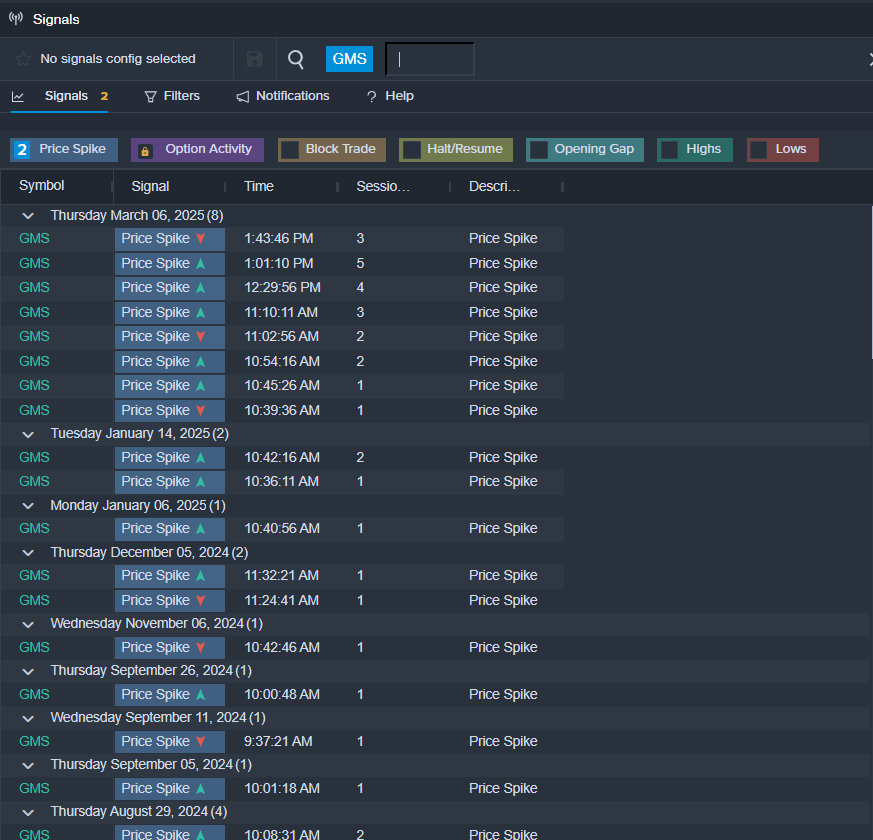

GMS Inc (NYSE:GMS)

- On March 6, GMS reported worse-than-expected third-quarter financial results. “Our results in the quarter reflect the impact of soft end market demand and steel pricing, both of which deteriorated meaningfully during the last half of the quarter, ultimately driving both lower than expected sales and gross margin compression, despite experiencing price and mix improvement in Wallboard and Ceilings,” said John C. Turner, Jr., President and CEO of GMS. The company's stock fell around 16% over the past month and has a 52-week low of $65.88.

- RSI Value: 24.1

- GMS Price Action: Shares of GMS fell 0.1% to close at $70.36 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in GMS shares.

Read This Next:

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved