Over the last 7 days, the United States market has risen by 1.7% and is up 10.0% over the past year, with earnings forecasted to grow by 14% annually. In this environment, identifying stocks that combine growth potential with solid fundamentals can uncover hidden opportunities for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that offers display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market capitalization of approximately $1.56 billion.

Operations: Himax generates revenue primarily from its display imaging processing technologies. The company's financial performance includes a notable net profit margin trend, which has varied across reporting periods.

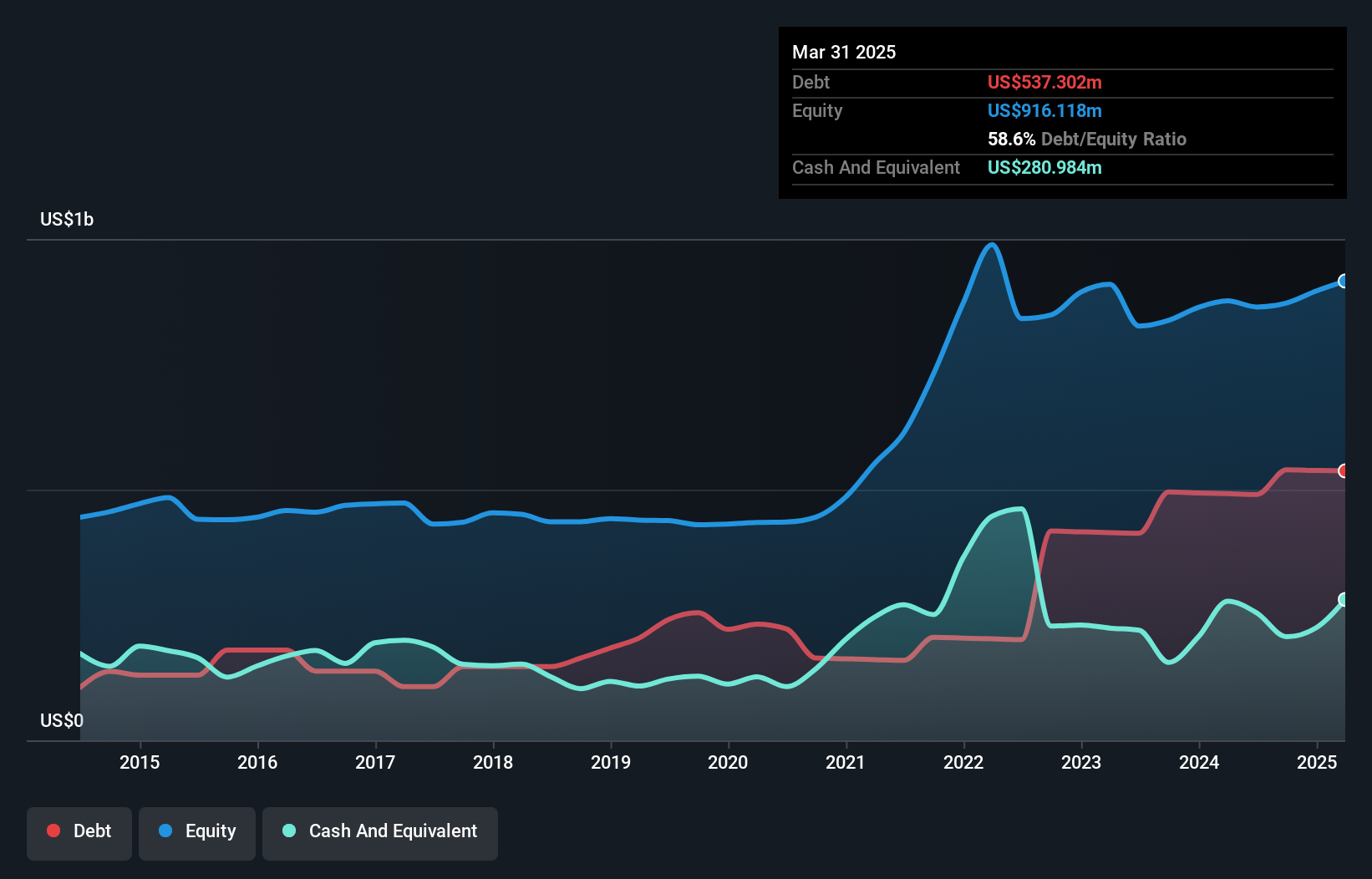

Himax Technologies, a small player in the semiconductor industry, is capturing attention with its strategic focus on automotive and AI technologies. Over the past year, earnings surged by 57.6%, outpacing the industry's -5.9% performance. Trading at a price-to-earnings ratio of 20.2x, below the industry average of 29.8x, it offers good value relative to peers. The company's debt to equity ratio has risen from 51% to 60% over five years but remains manageable with satisfactory interest coverage and net debt levels at 35%. Recent partnerships and advancements in TDDI and Co-Package Optics signal promising growth prospects despite market volatility challenges.

1st Source (NasdaqGS:SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States, with a market cap of approximately $1.50 billion.

Operations: 1st Source generates revenue primarily from its commercial banking segment, which contributed $374.66 million.

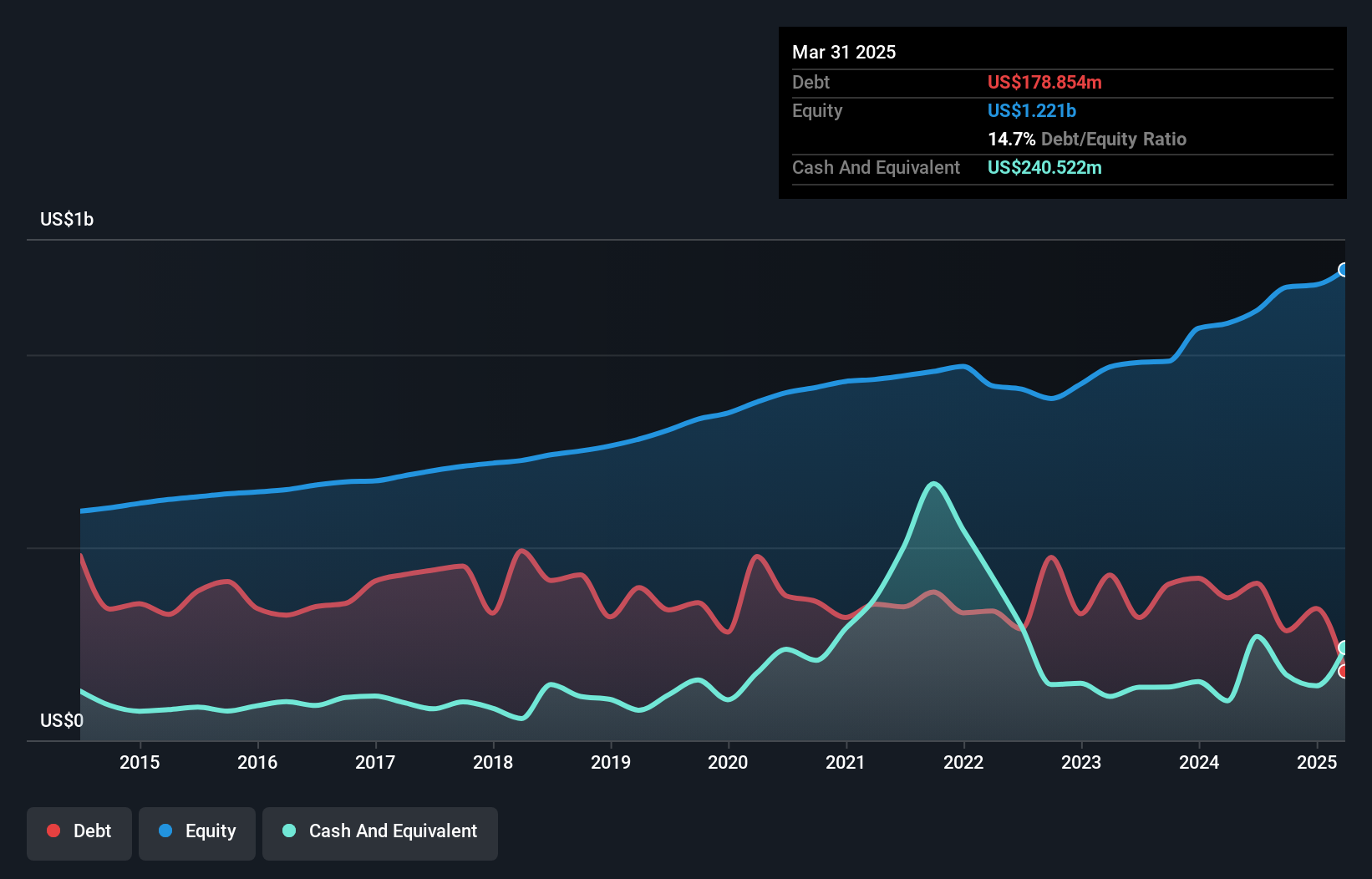

With total assets of US$8.9 billion and equity at US$1.2 billion, 1st Source showcases a robust financial position, supported by total deposits of US$7.2 billion and loans amounting to US$6.7 billion. The bank maintains a net interest margin of 3.6% while keeping bad loans at an appropriate level of 0.4%. Their allowance for bad loans stands impressively at 506%, indicating strong risk management practices. Recently, the company repurchased nearly 3,000 shares for US$0.18 million, reflecting confidence in its valuation as it trades significantly below estimated fair value by about 58%.

- Navigate through the intricacies of 1st Source with our comprehensive health report here.

Evaluate 1st Source's historical performance by accessing our past performance report.

First Bancshares (NYSE:FBMS)

Simply Wall St Value Rating: ★★★★★★

Overview: The First Bancshares, Inc. is the holding company for The First Bank, offering a range of commercial and retail banking services with a market capitalization of $1.07 billion.

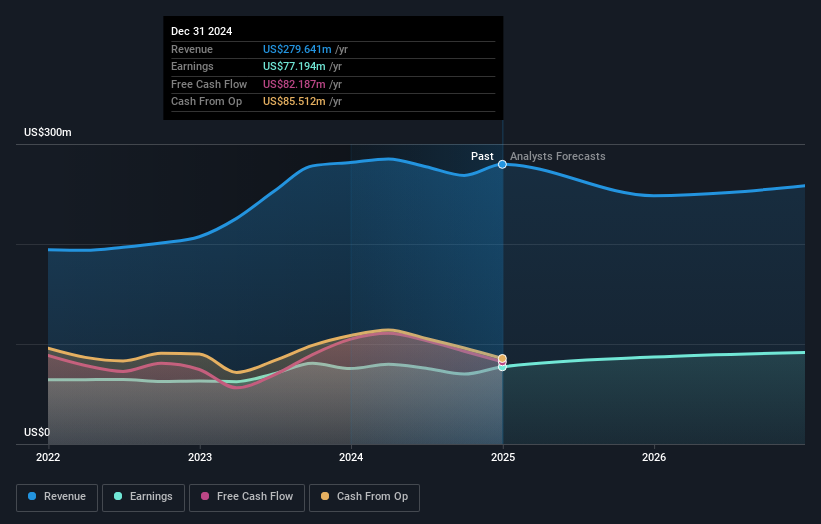

Operations: The First Bancshares generates revenue primarily from its commercial and retail banking services, amounting to $284.08 million, with an additional contribution of $3.54 million from its mortgage banking division. The holding company segment reported a negative revenue of -$7.38 million, impacting overall financial performance.

First Bancshares, with assets totaling US$8 billion and equity of US$1 billion, is making waves in the financial sector. The company boasts a strong net interest margin of 3.4% and has an impressive allowance for bad loans at 276%, ensuring stability against potential defaults. Its liabilities are primarily low-risk, with customer deposits forming the bulk at 94%. Recent earnings growth of 2.3% outpaced the broader banking industry, which saw a decrease of 1.5%. Despite challenges like increased loan loss provisions and competition, First Bancshares trades significantly below its estimated fair value by about 31.8%.

Make It Happen

- Explore the 281 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com