Over the last 7 days, the United States market has risen by 2.1%, contributing to a year-long climb of 8.1%, with earnings forecasted to grow by 14% annually. In this dynamic environment, discovering stocks that are undervalued or have strong growth potential can provide unique opportunities for investors looking to capitalize on emerging trends and robust financial performance.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Northeast Bank (NasdaqGM:NBN)

Simply Wall St Value Rating: ★★★★★★

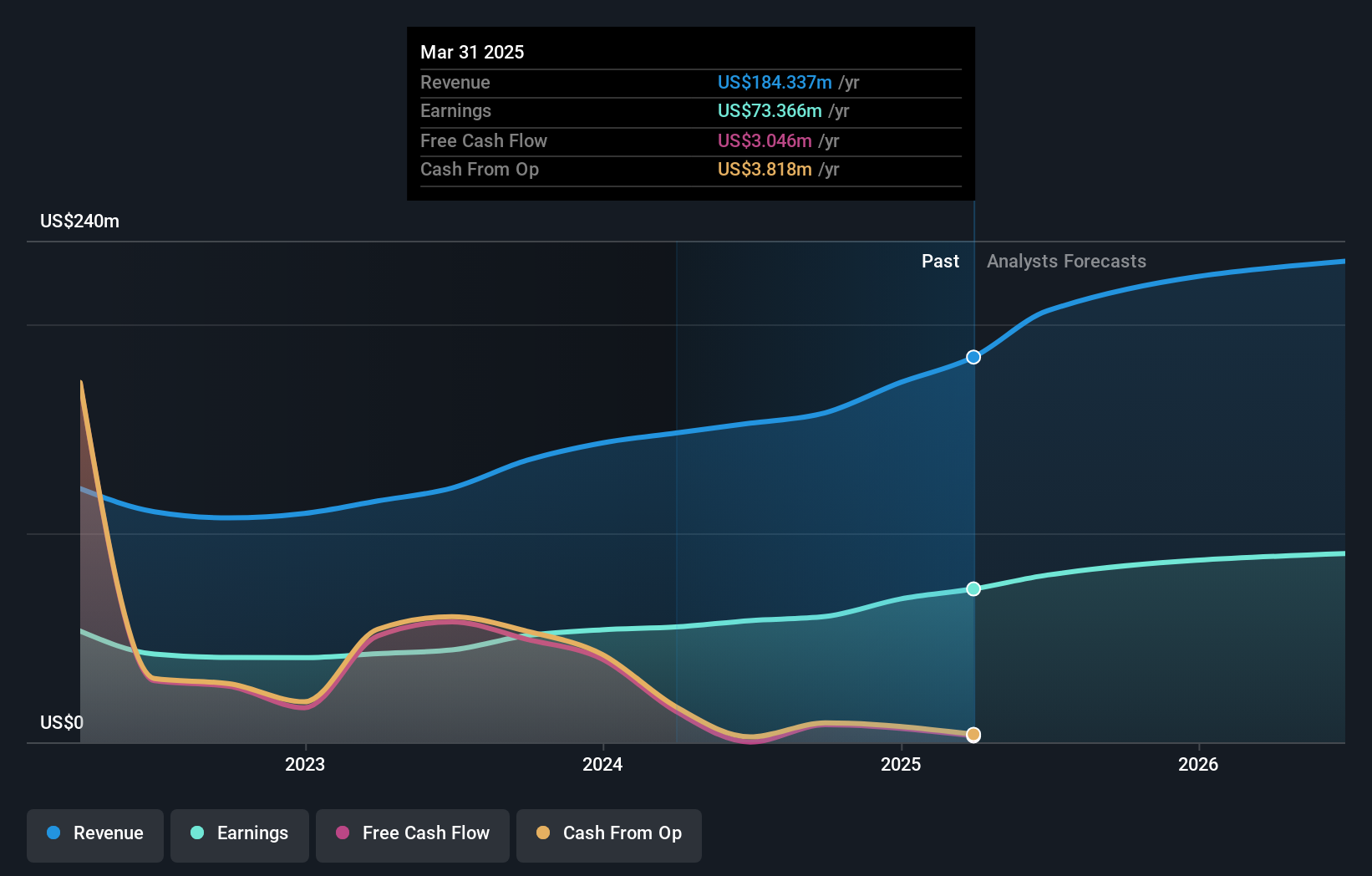

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market capitalization of approximately $786.18 million.

Operations: Northeast Bank generates revenue primarily through its banking segment, amounting to $172.13 million.

Northeast Bank, with total assets of US$4.1 billion and equity of US$444.1 million, stands out for its robust asset quality and growth potential in the banking sector. The bank's earnings surged by 27% last year, outpacing the industry’s performance. Its liabilities are primarily low-risk customer deposits, accounting for 87%, which enhances financial stability. A well-managed allowance for bad loans at 149% further underscores its prudent risk management approach. Trading at a significant discount to estimated fair value, Northeast Bank is poised to leverage its strong fundamentals amidst market opportunities and challenges alike.

Northwest Pipe (NasdaqGS:NWPX)

Simply Wall St Value Rating: ★★★★★☆

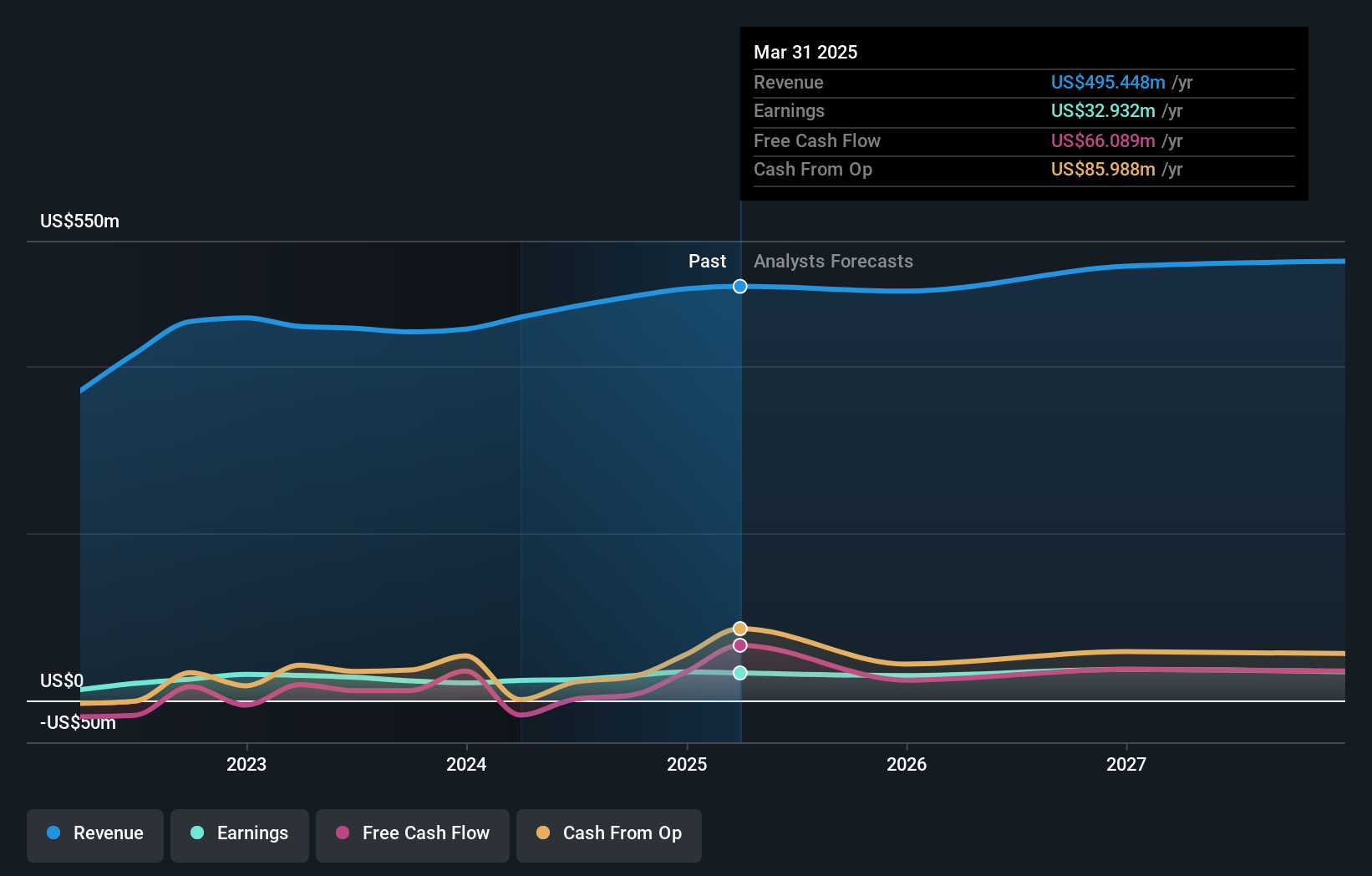

Overview: Northwest Pipe Company, with a market cap of $419.77 million, manufactures and sells water-related infrastructure products across North America and Canada.

Operations: The company generates revenue from two primary segments: Engineered Steel Pressure Pipe, contributing $337.95 million, and Precast Infrastructure and Engineered Systems, adding $154.60 million.

Northwest Pipe, a notable player in the infrastructure sector, has seen its earnings grow by 62% over the past year, outpacing industry averages. The company trades at a valuation 22.9% below its fair value estimate and maintains a satisfactory net debt to equity ratio of 9.1%. Recent expansions in Salt Lake City aim to boost production efficiency with advanced automation technology. Despite challenges from rising steel prices and tariffs that could pressure margins, Northwest Pipe's strategic focus on mergers and acquisitions alongside organic growth initiatives positions it well for future opportunities within the construction landscape.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

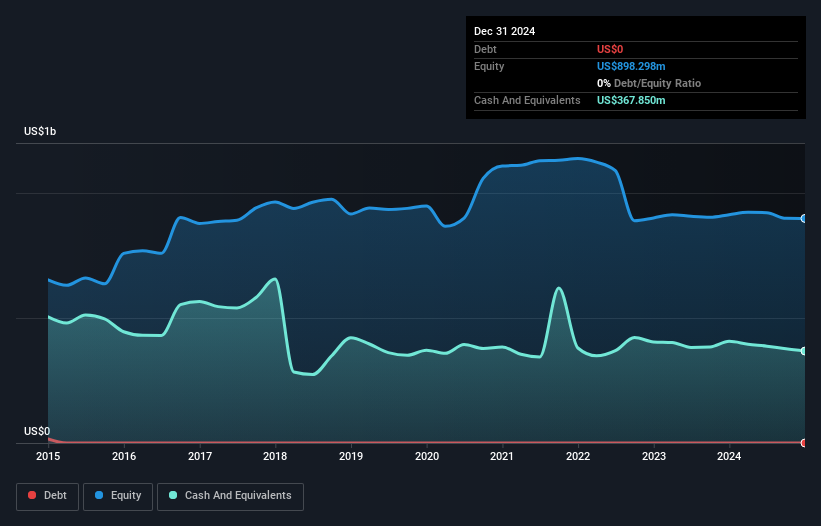

Overview: Associated Capital Group, Inc. is a company that offers investment advisory services in the United States, with a market capitalization of $767.09 million.

Operations: AC generates revenue primarily through its investment advisory and asset management services, with reported revenues of $13.18 million.

Earnings for Associated Capital Group have been on the rise, growing by 18% over the past year, surpassing industry growth of 17.8%. Despite a one-off gain of $42.8M affecting recent results, AC remains debt-free with a price-to-earnings ratio of 17.3x, just under the US market average. Recent executive changes see Patrick Huvane stepping in as interim CEO following Douglas R. Jamieson's retirement announcement as CEO and President effective March 2025. The company repurchased shares worth $2.3M last quarter and completed a significant buyback program totaling $90.68M since December 2015, showing confidence in its valuation strategy.

- Unlock comprehensive insights into our analysis of Associated Capital Group stock in this health report.

Gain insights into Associated Capital Group's past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 282 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com