Over the last 7 days, the United States market has risen by 1.8%, contributing to a 10% increase over the past year, with earnings forecasted to grow by 14% annually. In this thriving environment, identifying lesser-known stocks with strong fundamentals and growth potential can offer unique opportunities for investors seeking to complement their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

CRA International (NasdaqGS:CRAI)

Simply Wall St Value Rating: ★★★★★★

Overview: CRA International, Inc. offers economic, financial, and management consulting services globally and has a market cap of approximately $1.19 billion.

Operations: The primary revenue stream for CRA International comes from its consulting services, generating approximately $687.41 million. The company's market cap stands at around $1.19 billion.

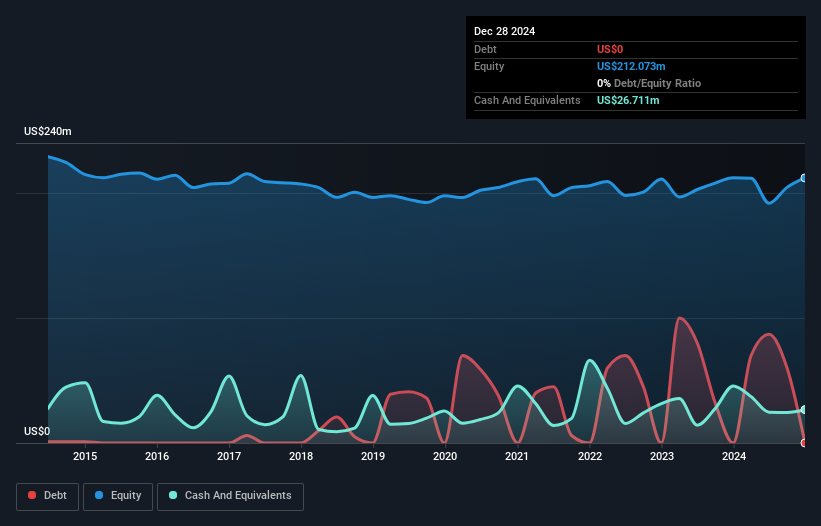

CRA International, a player in the consulting industry, has shown strong financial health with earnings growth of 21.5% over the past year, outpacing the Professional Services industry's 11%. The company is debt-free and trades at 36.2% below its estimated fair value, suggesting potential for stock appreciation. Recent executive changes include Daniel Mahoney's upcoming departure as CFO and Chad Holmes stepping in as interim CFO. Despite significant insider selling recently, CRA's strategic focus on Antitrust & Competition Economics positions it well for continued revenue growth amidst macroeconomic challenges and competitive pressures in talent acquisition.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★★☆

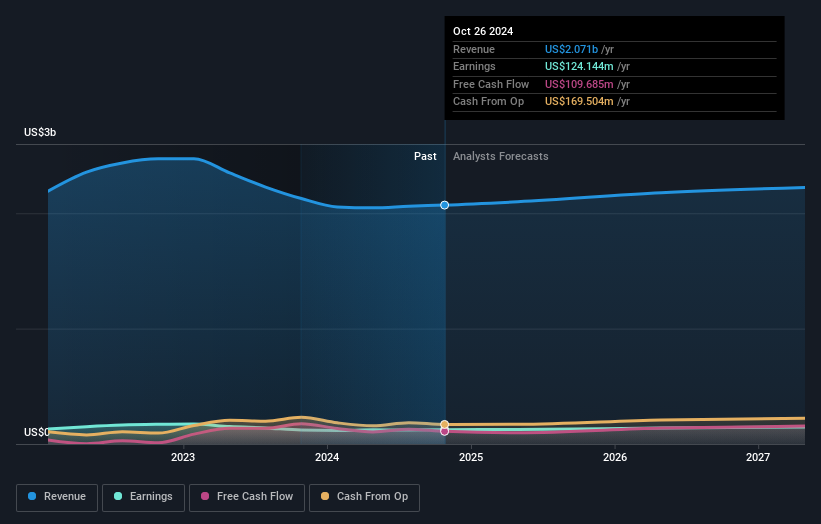

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market capitalization of $676.41 million.

Operations: World Acceptance generates revenue primarily from its consumer finance operations, totaling approximately $558.78 million. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of its operations and profitability relative to total revenue.

World Acceptance is navigating a strategic shift towards smaller loans, targeting higher credit quality customers. This move may bolster net margins by reducing risk exposure but could limit short-term revenue growth. The company's net debt to equity ratio stands at 127.1%, which is considered high, yet its interest payments are well covered with EBIT at 3.4 times those payments. Despite a notable earnings growth of 20.3% last year, surpassing the industry average of 18%, recent insider selling and a share buyback program worth US$25 million suggest mixed signals about future prospects amidst economic uncertainties.

La-Z-Boy (NYSE:LZB)

Simply Wall St Value Rating: ★★★★★★

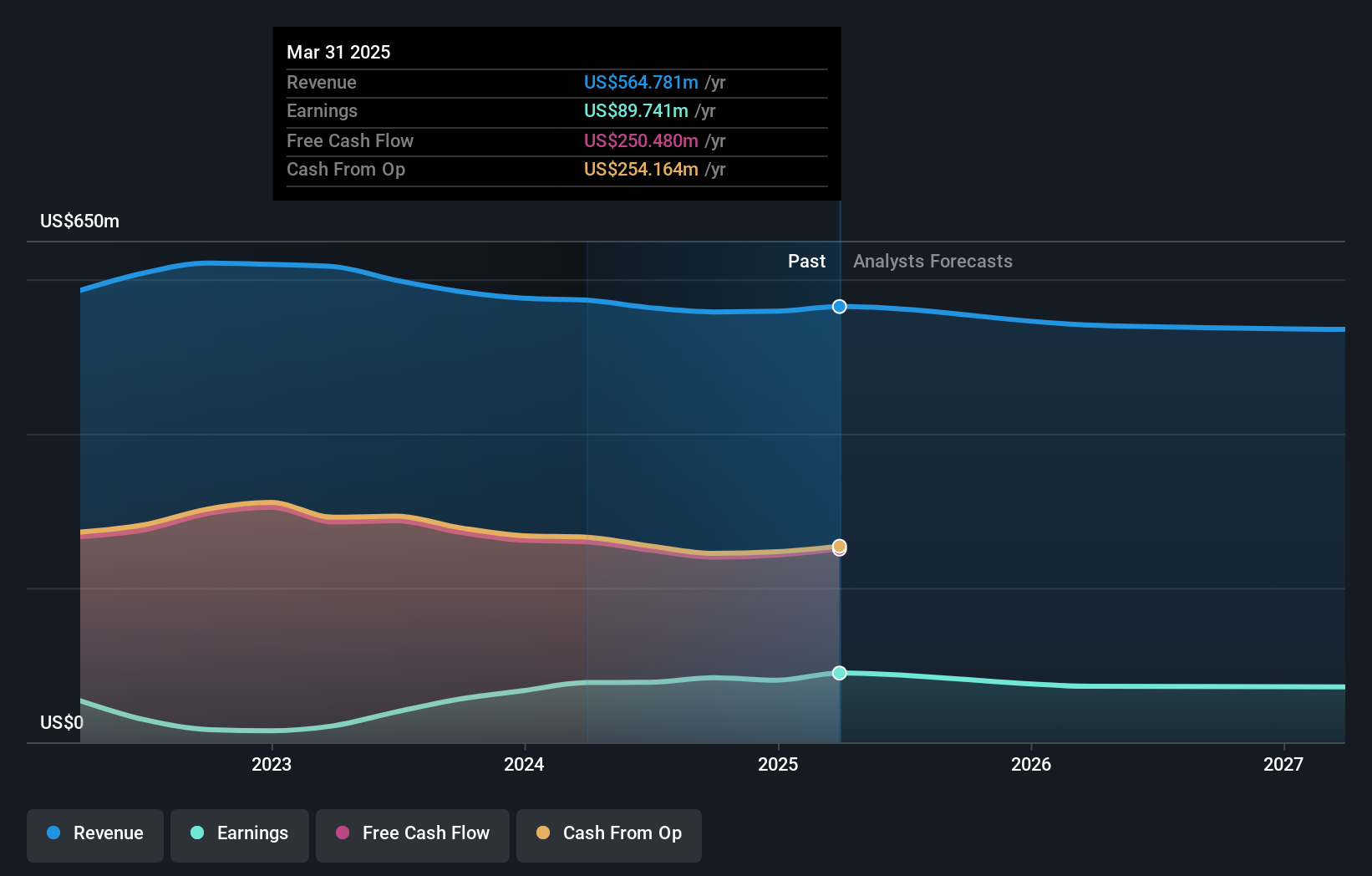

Overview: La-Z-Boy Incorporated is involved in the manufacturing, marketing, importing, exporting, distribution, and retail of upholstery furniture products across the United States, Canada, and internationally with a market capitalization of approximately $1.59 billion.

Operations: La-Z-Boy generates revenue primarily through its retail and wholesale segments, with retail contributing $879.48 million and wholesale $1.47 billion. The company experiences eliminations of $418.67 million within these segments, while corporate activities add $160.80 million to the financials.

La-Z-Boy, a notable player in the furniture industry, boasts high-quality earnings with an average annual growth of 9.7% over five years. The company is debt-free and trades at 25% below its estimated fair value, offering potential for appreciation. Recent third-quarter results showed sales of US$521.78 million and net income of US$28.43 million, reflecting steady performance compared to last year’s figures. Despite facing market challenges and international disruptions, La-Z-Boy's strategic initiatives aim to enhance retail presence and supply chain efficiency, potentially driving future revenue growth while maintaining profitability through share buybacks and dividends.

Taking Advantage

- Discover the full array of 286 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com