Throughout the last three months, 12 analysts have evaluated Kilroy Realty (NYSE:KRC), offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 10 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 3 | 0 | 0 |

| 2M Ago | 1 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

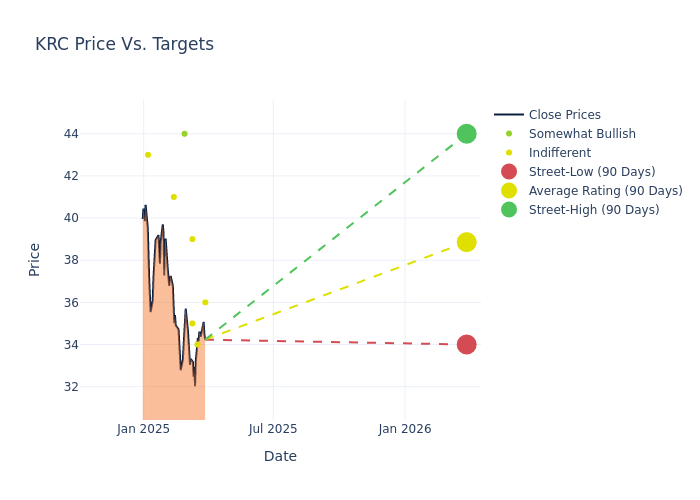

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $40.33, a high estimate of $44.00, and a low estimate of $34.00. This current average has decreased by 8.15% from the previous average price target of $43.91.

Interpreting Analyst Ratings: A Closer Look

The perception of Kilroy Realty by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Caitlin Burrows | Goldman Sachs | Lowers | Neutral | $36.00 | $42.00 |

| Peter Abramowitz | Jefferies | Announces | Hold | $34.00 | - |

| Michael Carroll | RBC Capital | Lowers | Sector Perform | $39.00 | $44.00 |

| Blaine Heck | Wells Fargo | Lowers | Equal-Weight | $35.00 | $43.00 |

| Brendan Lynch | Barclays | Raises | Overweight | $44.00 | $42.00 |

| Caitlin Burrows | Goldman Sachs | Lowers | Buy | $42.00 | $48.00 |

| Steve Sakwa | Evercore ISI Group | Lowers | In-Line | $41.00 | $43.00 |

| Michael Carroll | RBC Capital | Maintains | Sector Perform | $44.00 | $44.00 |

| Brendan Lynch | Barclays | Lowers | Equal-Weight | $42.00 | $43.00 |

| Brendan Lynch | Barclays | Lowers | Equal-Weight | $43.00 | $44.00 |

| Vikram Malhotra | Mizuho | Lowers | Neutral | $43.00 | $45.00 |

| Peter Abramowitz | Jefferies | Lowers | Hold | $41.00 | $45.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kilroy Realty. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Kilroy Realty compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Kilroy Realty's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Kilroy Realty's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Kilroy Realty analyst ratings.

All You Need to Know About Kilroy Realty

Kilroy Realty is a premier owner and landlord of approximately 17 million square feet of office space across Los Angeles, San Diego, the San Francisco Bay Area, Austin, Texas, and greater Seattle. The company operates as a real estate investment trust.

Key Indicators: Kilroy Realty's Financial Health

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Kilroy Realty's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 6.45%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 20.7%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Kilroy Realty's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.1%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Kilroy Realty's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.53%, the company showcases efficient use of assets and strong financial health.

Debt Management: Kilroy Realty's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.88.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.