As of April 1, 2025, three stocks in the communication services sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Fox Corp (NASDAQ:FOXA)

- On March 26, Wells Fargo analyst Steven Cahall maintained Fox with an Overweight rating and lowered the price target from $64 to $63. The company's stock gained around 6% over the past five days and has a 52-week high of $58.74.

- RSI Value: 70.9

- FOXA Price Action: Shares of Fox gained 3.4% to close at $56.60 on Monday.

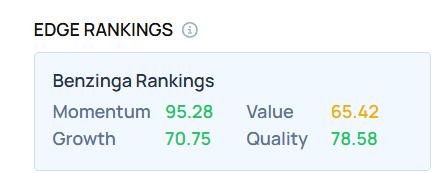

- Edge Stock Ratings: 95.28 Momentum score with Value at 65.42.

AT&T Inc (NYSE:T)

- On March 31, Citigroup analyst Michael Rollins maintained AT&T with a Buy and raised the price target from $28 to $32. The company's stock gained around 5% over the past five days and has a 52-week high of $28.56.

- RSI Value: 70.2

- T Price Action: Shares of AT&T gained 0.4% to close at $28.28 on Monday.

Tim SA (NYSE:TIMB)

- On March 17, Barclays analyst Mathieu Robilliard maintained TIM with an Equal-Weight rating and raised the price target from $16 to $16.5. The company's stock gained around 12% over the past month and has a 52-week high of $18.78.

- RSI Value: 74.5

- TIMB Price Action: Shares of Tim gained 1.4% to close at $15.65 on Monday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock