Over the last 7 days, the United States market has experienced a 3.0% decline, yet it remains up by 7.5% over the past year with anticipated earnings growth of 14% per annum in the coming years. In this dynamic environment, identifying promising small-cap stocks like Nutex Health can be key to uncovering potential opportunities that align with these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Nutex Health (NasdaqCM:NUTX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nutex Health Inc. is a physician-led healthcare services and operations company with a market cap of $388.20 million.

Operations: Nutex Health generates revenue through its healthcare services operations. The company has a market cap of $388.20 million, reflecting its position in the healthcare sector.

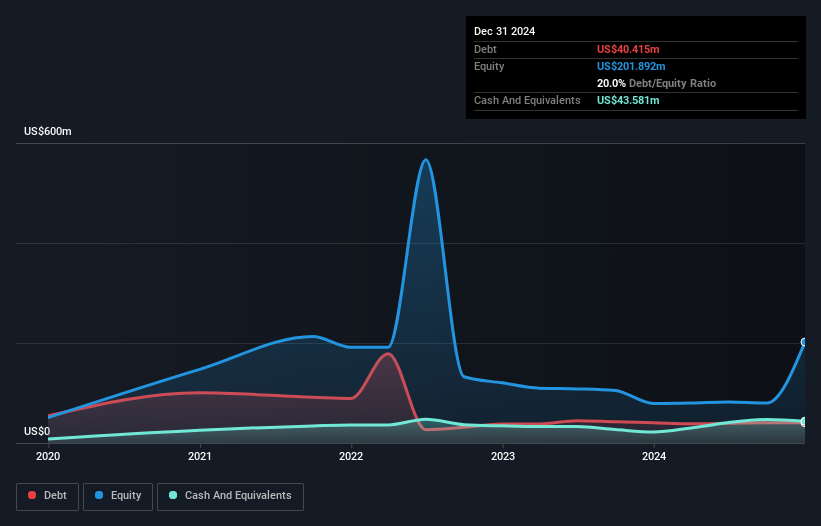

Nutex Health, a dynamic player in healthcare, has made impressive strides with its debt to equity ratio dropping from 106.7% to 20% over five years. The company now holds more cash than total debt, showcasing financial resilience. In the past year, Nutex turned profitable with earnings covering interest payments 6.9 times over EBIT, highlighting robust operations. Recent earnings reveal a significant turnaround: fourth-quarter revenue soared to US$257 million from US$70 million last year and net income reached US$61.7 million compared to a previous loss of US$31.62 million, reflecting strong growth and promising prospects for this emerging healthcare entity.

- Click here and access our complete health analysis report to understand the dynamics of Nutex Health.

Gain insights into Nutex Health's historical performance by reviewing our past performance report.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc. is a company that offers a range of information technology solutions globally and has a market capitalization of approximately $1.63 billion.

Operations: PC Connection generates revenue primarily through its three segments: Business Solutions ($1.05 billion), Enterprise Solutions ($1.18 billion), and Public Sector Solutions ($571.83 million). The company's net profit margin is a key financial metric to consider when evaluating its performance.

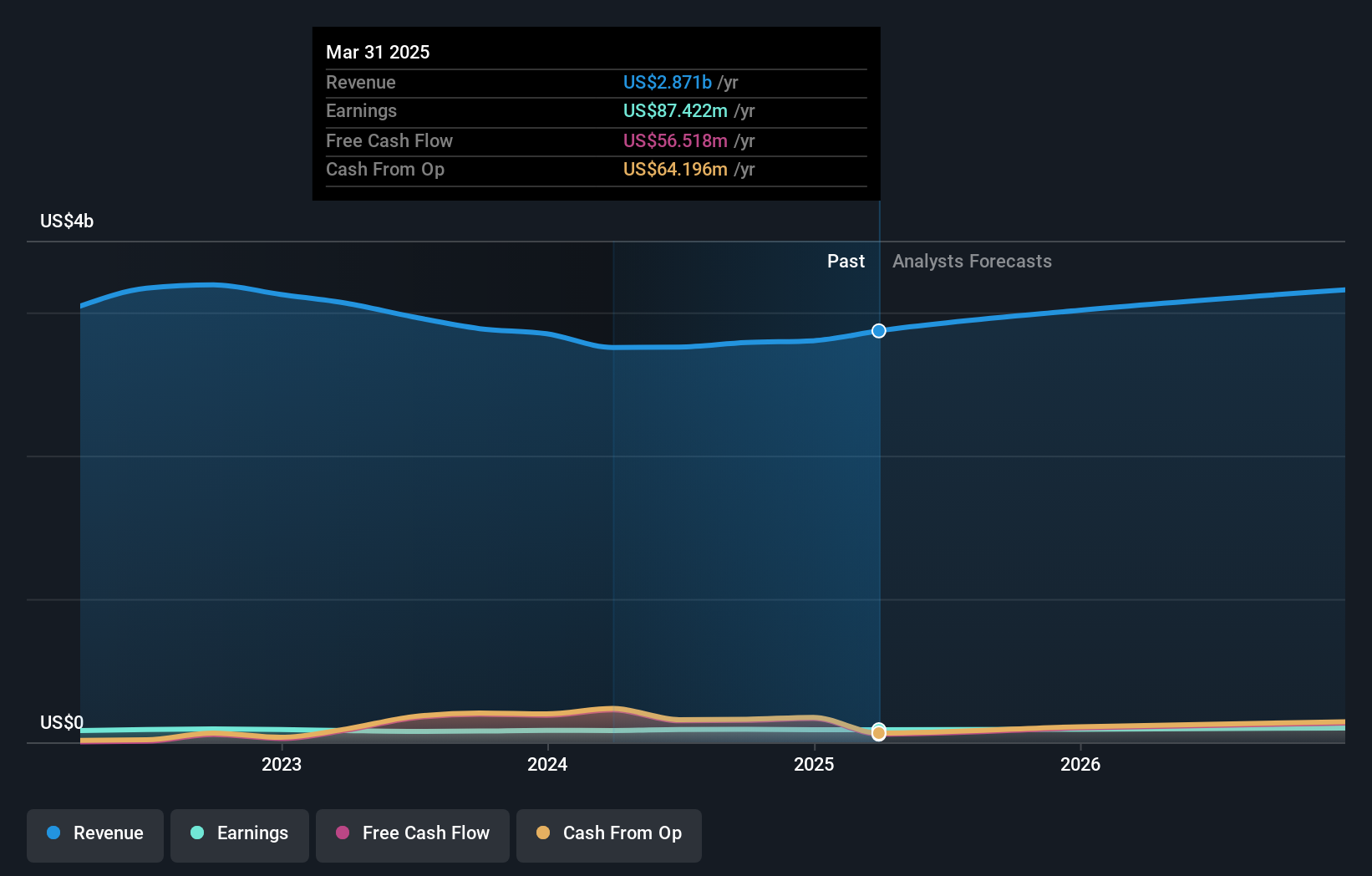

PC Connection is making strides with strategic investments in AI and CRM systems, aimed at boosting operational efficiency and service capabilities, particularly in healthcare and retail sectors. Over the past year, earnings grew by 4.6%, outpacing the electronic industry's -6.8% performance, while maintaining a Price-to-Earnings ratio of 19x, which is favorable compared to the industry average of 20.9x. The company has no debt concerns and recently repurchased shares worth $4.9 million from October to December 2024, reflecting management's confidence in future prospects despite challenges like lower IT spending and supply chain issues.

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of $598.50 million.

Operations: Heritage generates revenue primarily from its property and casualty insurance segment, amounting to $816.99 million.

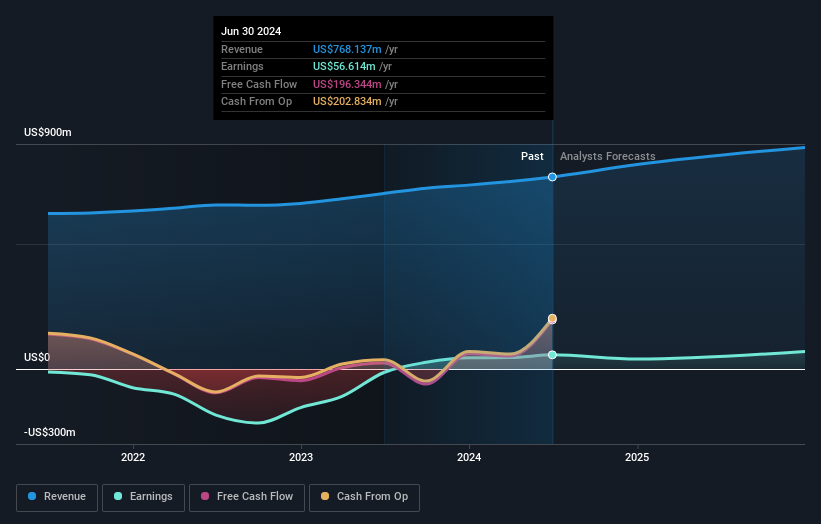

Heritage Insurance Holdings, a smaller player in the insurance sector, shows promise with its price-to-earnings ratio at 10x, which is lower than the US market average of 17.5x. The company reported annual earnings growth of 35.8%, outpacing the industry’s 22%. Despite an increase in debt to equity from 28.8% to 40% over five years, Heritage maintains more cash than total debt and covers interest payments well with EBIT at an impressive 8.6x coverage. Recent earnings reveal net income rose to US$61 million from US$45 million last year, reflecting solid financial health and operational efficiency improvements.

Where To Now?

- Click through to start exploring the rest of the 278 US Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com