Over the last 7 days, the United States market has dropped 3.0%, though it is up 7.5% over the past year and earnings are expected to grow by 14% per annum in the coming years. In this context, identifying promising small-cap stocks with insider buying can be a strategic approach for investors looking to capitalize on potential growth opportunities amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 11.1x | 1.5x | 29.22% | ★★★★★☆ |

| Shore Bancshares | 10.3x | 2.3x | 8.62% | ★★★★☆☆ |

| First United | 9.4x | 2.5x | 48.91% | ★★★★☆☆ |

| PDF Solutions | 184.9x | 4.2x | 22.48% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 20.30% | ★★★★☆☆ |

| West Bancorporation | 13.7x | 4.2x | 44.75% | ★★★☆☆☆ |

| Franklin Financial Services | 14.1x | 2.3x | 33.62% | ★★★☆☆☆ |

| Union Bankshares | 16.1x | 3.0x | 38.87% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -248.52% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -339.73% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

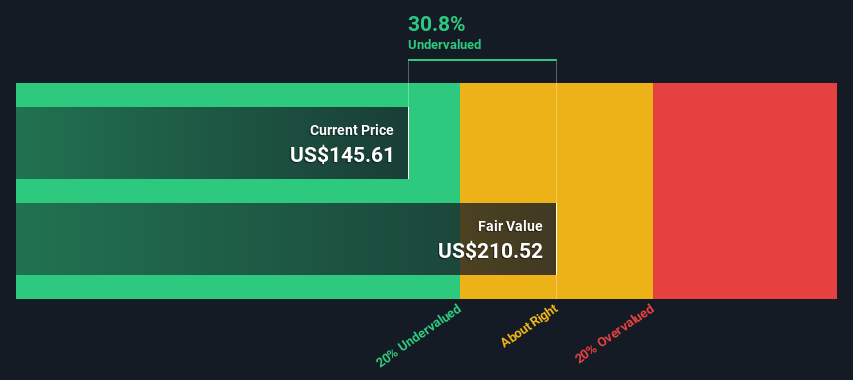

Diamond Hill Investment Group (NasdaqGS:DHIL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Diamond Hill Investment Group is a company that provides investment advisory and fund administration services, with a market capitalization of approximately $0.53 billion.

Operations: The company generates revenue primarily from investment advisory and fund administration services, with a recent quarterly revenue of $151.10 million. The cost of goods sold (COGS) stands at $82.91 million, leading to a gross profit margin of 45.13%. Operating expenses are recorded at $24.29 million, impacting the net income margin which is currently 28.58%.

PE: 9.3x

Diamond Hill Investment Group, a smaller player in the financial sector, shows potential for value-seeking investors. Despite earnings declining by 2% annually over five years, recent insider confidence is evident with Richard Cooley purchasing 1,000 shares for US$152,250. The company reported a revenue increase to US$151.1 million and net income of US$43.18 million for 2024. Additionally, they repurchased 52,799 shares worth US$8.54 million in late 2024 and continue to pay regular dividends of $1.50 per share quarterly.

- Delve into the full analysis valuation report here for a deeper understanding of Diamond Hill Investment Group.

Learn about Diamond Hill Investment Group's historical performance.

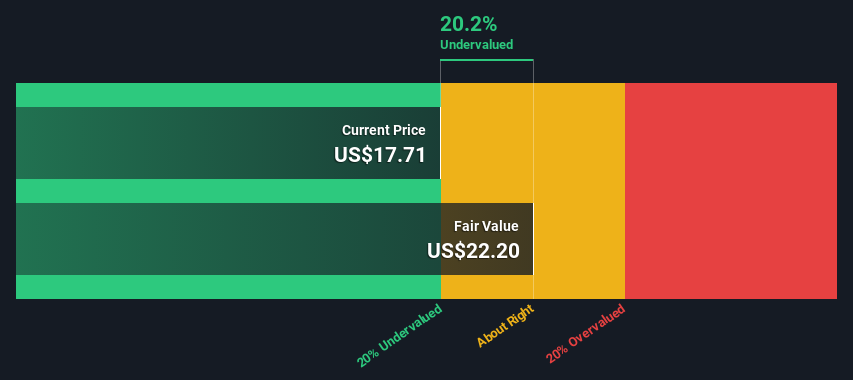

RBB Bancorp (NasdaqGS:RBB)

Simply Wall St Value Rating: ★★★★★★

Overview: RBB Bancorp operates as a bank holding company offering commercial banking services primarily to small and medium-sized businesses, with a market capitalization of approximately $0.37 billion.

Operations: RBB Bancorp generates revenue primarily from its banking operations, with recent figures showing $104.84 million in revenue. The company consistently reports a gross profit margin of 100%, indicating no cost of goods sold is recorded. Operating expenses are significant, with general and administrative expenses being the largest component, amounting to $60.96 million in the latest period. Net income margin has shown variability over time, recently recorded at 25.43%.

PE: 11.0x

RBB Bancorp, a smaller financial institution, is currently navigating significant challenges. Despite insider confidence shown by James W. Kao's purchase of 9,312 shares valued at US$160,743 in early 2025, the bank faces legal issues with fraud allegations and predatory lending practices. Recent earnings reports reveal decreased net income of US$4.39 million for Q4 2024 compared to the previous year's US$12.07 million, highlighting financial pressures amid these controversies and a high bad loans ratio of 2.7%.

- Click here and access our complete valuation analysis report to understand the dynamics of RBB Bancorp.

Examine RBB Bancorp's past performance report to understand how it has performed in the past.

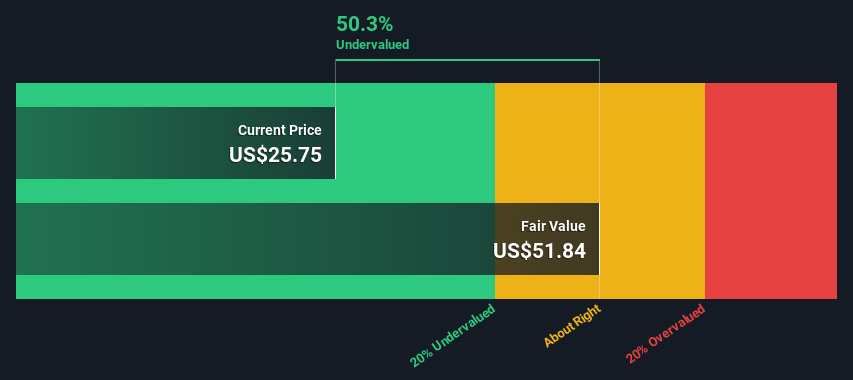

PROG Holdings (NYSE:PRG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PROG Holdings operates primarily through its Progressive Leasing segment, providing lease-to-own solutions, and has a market capitalization of approximately $1.59 billion.

Operations: The company's primary revenue stream is Progressive Leasing, generating $2.37 billion, while Vive and another segment contribute $64.42 million and $32.59 million respectively. Over recent periods, the gross profit margin has shown an upward trend, reaching 34.20% by the end of 2025-04-01.

PE: 5.7x

PROG Holdings, a smaller company in the U.S., has recently shown signs of insider confidence with Independent Director Douglas Curling purchasing 10,000 shares for US$298,800. This move suggests belief in the company's potential despite earnings forecasted to decline by an average of 3.2% annually over the next three years. In Q4 2024, PROG reported increased net income of US$57.55 million from US$18.58 million a year prior and completed significant share repurchases totaling US$940.93 million since November 2021, enhancing shareholder value amidst high debt levels and external borrowing risks.

- Click to explore a detailed breakdown of our findings in PROG Holdings' valuation report.

Review our historical performance report to gain insights into PROG Holdings''s past performance.

Turning Ideas Into Actions

- Access the full spectrum of 90 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com