The Concentrix Corporation (NASDAQ:CNXC) share price has done very well over the last month, posting an excellent gain of 26%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.7% in the last twelve months.

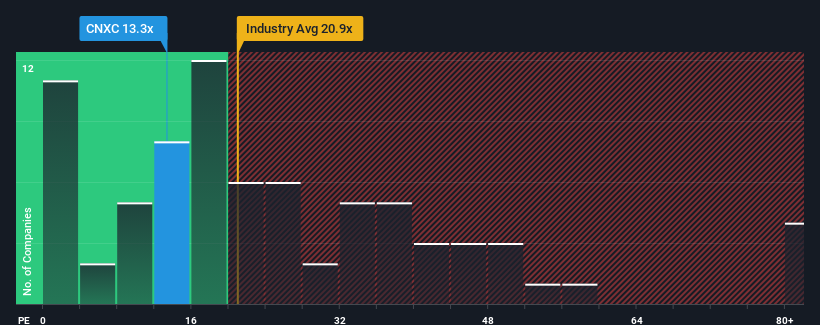

In spite of the firm bounce in price, Concentrix may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.3x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Concentrix hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Concentrix

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Concentrix's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 50% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the six analysts watching the company. With the market only predicted to deliver 14%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Concentrix's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Concentrix's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Concentrix currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Concentrix you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of Concentrix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.