Top 3 Consumer Stocks That Are Set To Fly This Quarter

Benzinga · 04/04 10:54

Share

Listen to the news

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

JAKKS Pacific Inc (NASDAQ:JAKK)

- On March 18, Small Cap Consumer Research analyst Eric Beder reiterated Jakks Pacific with a Buy and maintained a $40 price target. The company's stock fell around 15% over the past five days and has a 52-week low of $17.06.

- RSI Value: 25.2

- JAKK Price Action: Shares of JAKKS Pacific fell 13.9% to close at $21.36 on Thursday.

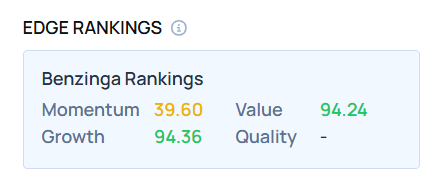

- Edge Stock Ratings: 39.60 Momentum score with Value at 94.24.

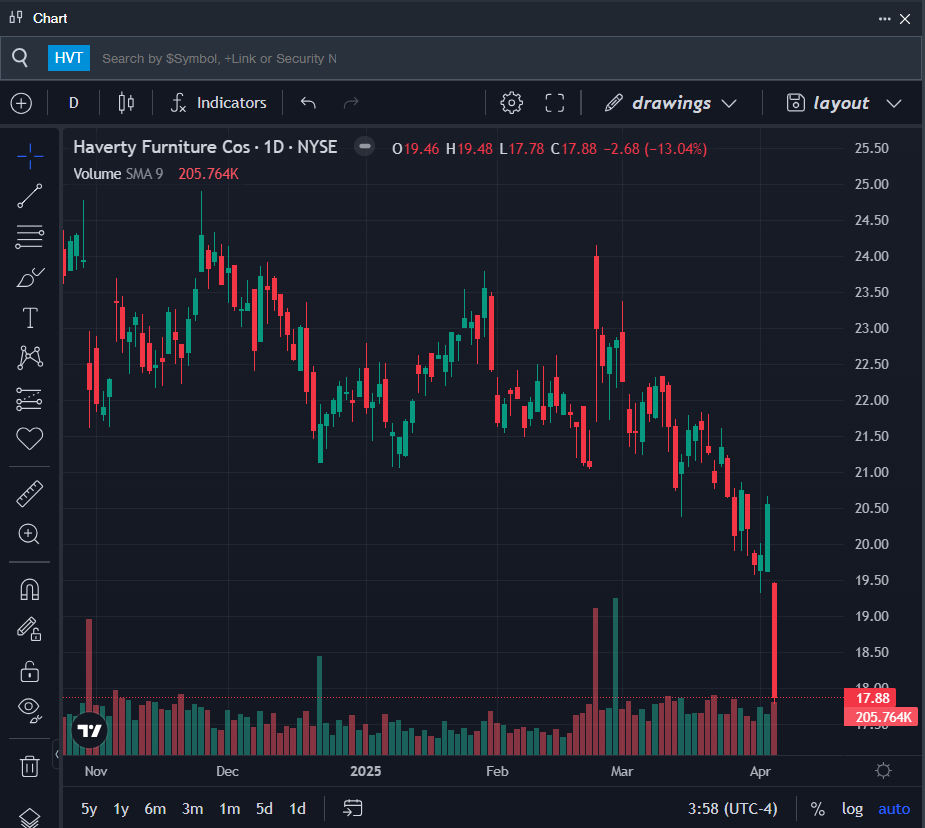

Haverty Furniture Companies Inc (NYSE:HVT)

- On Feb. 24, Haverty Furniture reported fourth-quarter financial results and beat its EPS and revenue estimates. Steven G. Burdette, President and CEO, said, “Our team remained disciplined in managing our operations and executing our growth strategies, even amidst the housing slowdown. We achieved our goal of opening five net new stores in 2024, with a notable return to the Houston, TX market after approximately 40 years, where we now have two stores.” The company's stock fell around 17% over the past month and has a 52-week low of $17.78.

- RSI Value: 27.1

- HVT Price Action: Shares of Haverty Furniture dipped 13% to close at $17.88 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in HVT stock.

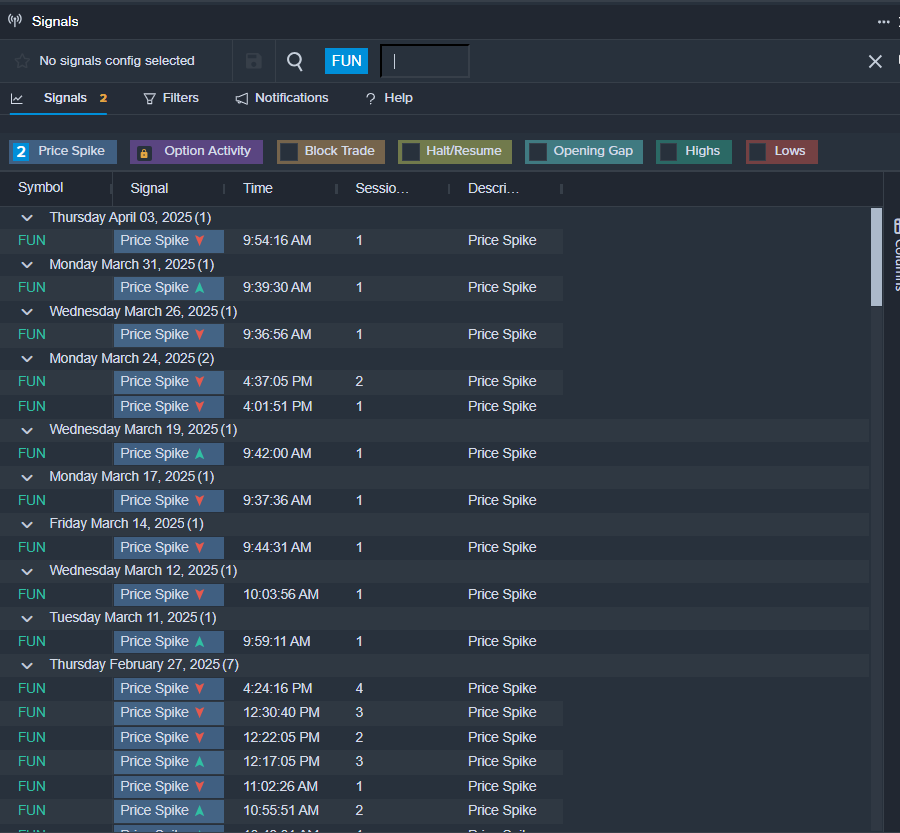

Six Flags Entertainment Corp (NYSE:FUN)

- On March 25, Truist Securities analyst Michael Swartz maintained Six Flags Entertainment with a Buy and lowered the price target from $56 to $52. The company's stock fell around 21% over the past month and has a 52-week low of $31.33.

- RSI Value: 27.7

- FUN Price Action: Shares of Six Flags Entertainment fell 14.4% to close at $31.98 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in FUN shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved