ZEEKR Intelligent Technology Holding Limited (NYSE:ZK) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

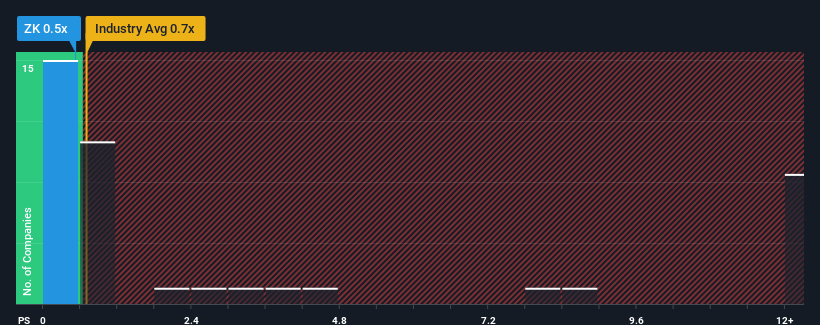

Although its price has dipped substantially, it's still not a stretch to say that ZEEKR Intelligent Technology Holding's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Auto industry in the United States, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for ZEEKR Intelligent Technology Holding

What Does ZEEKR Intelligent Technology Holding's P/S Mean For Shareholders?

Recent times have been advantageous for ZEEKR Intelligent Technology Holding as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZEEKR Intelligent Technology Holding .How Is ZEEKR Intelligent Technology Holding's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like ZEEKR Intelligent Technology Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 43% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 17% per annum growth forecast for the broader industry.

In light of this, it's curious that ZEEKR Intelligent Technology Holding's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From ZEEKR Intelligent Technology Holding's P/S?

Following ZEEKR Intelligent Technology Holding's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at ZEEKR Intelligent Technology Holding's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for ZEEKR Intelligent Technology Holding that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.