International Seaways (NYSE:INSW) witnessed a notable drop of 13% in its share price over the past week, reflecting the broader market turmoil that saw the Dow and S&P 500 fall sharply due to escalating global trade tensions. The announcement of sweeping tariffs and the subsequent market sell-off have created significant uncertainty and disruption across sectors. Additionally, energy stocks, in particular, have faced pressure from falling oil prices amid concerns over global economic growth. As a participant in the energy sector, International Seaways has likely felt the impact of these broader market fluctuations, contributing to its recent stock decline.

Over the past three years, International Seaways has achieved a 102.10% total return, showcasing the company's resilience despite recent market volatility. This return outperformed many peers and the broader market. A key factor was the company's ongoing fleet modernization, which, although costly, improved operating efficiency. This effort, along with the limited supply of new ships, has supported tanker demand and earnings.

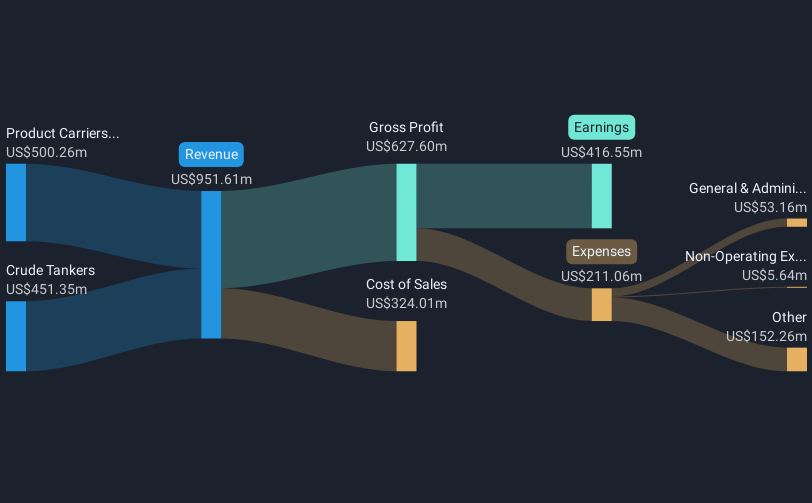

Significant buyback activity further bolstered shareholder value, with substantial repurchases carried out over the period. The company's determination to provide shareholder returns was evident in its multiple supplemental dividends, including payments declared as recently as February 2025. However, recent performance struggles, such as declining revenues reported in the full-year 2024 earnings announcement, have raised some investor concerns about the sustainability of these returns moving forward. Nonetheless, the earlier capital initiatives and favorable fleet positioning have been central to its three-year performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com