Corpay (NYSE:CPAY) recently expanded its European footprint by opening an office in Luxembourg, a move strategically positioned to tap into key financial markets. Concurrently, the appointment of Alissa Vickery as interim CFO ensured continuity during a financial transition. However, these developments came amid broader market turmoil, as global markets tumbled due to the U.S.-China tariff exchange, with the S&P 500 and Nasdaq experiencing significant downturns. The 9.4% market drop over the last week contrasts starkly against Corpay’s 14% decline over the past month, reflecting heightened investor caution and financial uncertainties impacting the company’s shares.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments involving Corpay's expansion and CFO appointment are significant amidst broader market turmoil. While the Luxembourg office opens avenues in key financial markets, the ongoing U.S.-China tariff tensions pose economic challenges that could impact projected revenue growth and earnings. The company's focus on expanding its corporate payments sector suggests potential long-term competitiveness, although current external pressures could influence short-term financial performance.

Over the past five years, Corpay's total shareholder return, including share price and dividends, was 28.26%. This performance stands in contrast to its more recent challenges, with a significant share price decline over the past month compared to industry averages. Within the last year, however, Corpay underperformed the US Diversified Financial industry, which returned 9%.

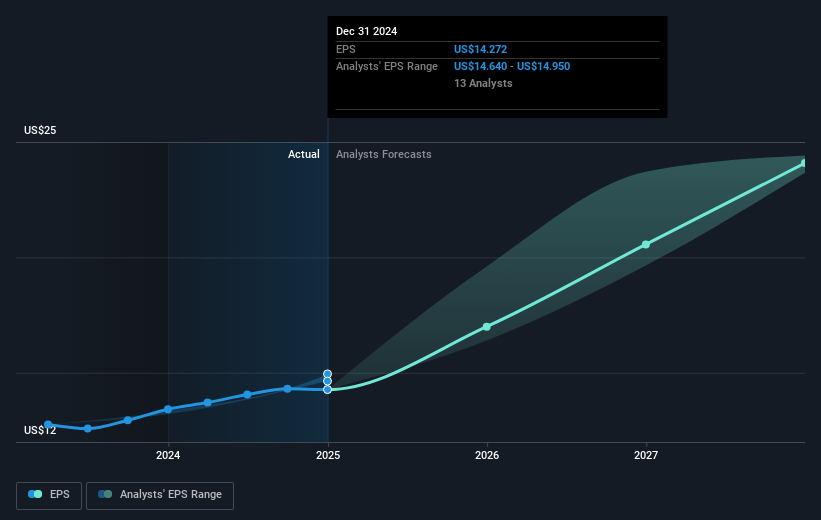

The strategic initiatives introduced are intended to bolster revenue and earnings forecasts. Analysts anticipate revenue growth driven by expansion into Europe and increased U.S. sales investments. Achieving the consensus price target of $415.18 relies on improving these core metrics, despite the current share price being at a discount. While the market conditions remain volatile, the company's strategic steps are aimed at stabilizing its financial outlook and aligning share trajectory with optimistic price targets.

Our valuation report unveils the possibility Corpay's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com