Top 3 Industrials Stocks You May Want To Dump This Month

Benzinga · 04/08 13:16

Share

Listen to the news

As of April 8, 2025, three stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Mesa Air Group Inc (NASDAQ:MESA)

- On April 7, Mesa Air Group and Republic Airways Holdings Inc announced a merger agreement to create a major player in the regional airline market. "Today's announcement is an exciting next step in Mesa's more than 40-year history, one that represents the best outcome for our shareholders, employees, and all of our stakeholders," said Mesa's Chairman and CEO, Jonathan Ornstein. The company's stock gained around 39% over the past five days and has a 52-week high of $1.89.

- RSI Value: 71.7

- MESA Price Action: Shares of Mesa Air gained 54.9% to close at $1.10 on Monday.

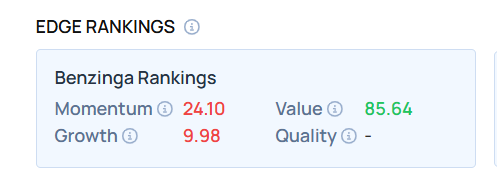

- Edge Stock Ratings: 24.10 Momentum score with Value at 85.64.

eLong Power Holding Ltd (NASDAQ:ELPW)

- On March 25, Elong Power received staff determination notices from Nasdaq. The company's stock gained around 51% over the past five days and has a 52-week high of $12.60.

- RSI Value: 74.1

- ELPW Price Action: Shares of eLong Power gained 18.6% to close at $1.06 on Monday.

Markforged Holding Corp (NYSE:MKFG)

- On March 28, Markforged Holding posted downbeat quarterly sales. “We are encouraged by the continued adoption of our next generation product line, despite the challenging market conditions that we are facing,” said Shai Terem, President and CEO of Markforged. The company's stock gained around 94% over the past month and has a 52-week high of $7.50.

- RSI Value: 73.1

- MKFG Price Action: Shares of Markforged Holding fell 0.9% to close at $4.55 on Monday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved