As the U.S. market grapples with heightened volatility and concerns over tariffs, small-cap stocks, particularly those in the S&P 600 index, have been significantly impacted by these economic uncertainties. Amid this backdrop of fluctuating indices and broader market sentiment, identifying small-cap stocks that exhibit strong fundamentals and potential resilience can be a prudent strategy for investors looking to navigate these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.8x | 3.4x | 47.88% | ★★★★★★ |

| Plymouth Industrial REIT | 4.4x | 3.2x | 42.32% | ★★★★★★ |

| Shore Bancshares | 9.0x | 2.0x | 19.98% | ★★★★★☆ |

| Flowco Holdings | 5.6x | 0.8x | 45.80% | ★★★★★☆ |

| Thryv Holdings | NA | 0.5x | 38.80% | ★★★★★☆ |

| MVB Financial | 10.5x | 1.4x | 38.22% | ★★★★☆☆ |

| PDF Solutions | 158.2x | 3.6x | 29.35% | ★★★★☆☆ |

| Franklin Financial Services | 13.3x | 2.1x | 42.24% | ★★★☆☆☆ |

| Claritev | NA | 0.3x | -5868.09% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -266.62% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Daktronics (NasdaqGS:DAKT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Daktronics specializes in designing and manufacturing electronic scoreboards, programmable display systems, and large-screen video displays, with a market cap of approximately $0.21 billion.

Operations: The company's revenue is primarily driven by its Live Events and High School Park and Recreation segments, contributing significantly to its total income. Over recent periods, the gross profit margin has shown a notable increase from 16.60% to 27.19%. Operating expenses include significant allocations for Sales & Marketing and R&D activities, which are crucial components of its cost structure.

PE: 309.7x

Daktronics, a US-based company, is navigating through executive changes and strategic shifts. With recent insider confidence shown through share purchases and a completed buyback of 2.5 million shares for US$22.86 million, the company demonstrates commitment to shareholder value. Despite reporting a third-quarter net loss of US$17.16 million against last year's profit, Daktronics is focused on transformation under new leadership with plans to reincorporate in Delaware for enhanced governance. Future earnings growth is forecasted at 105% annually, suggesting potential upside amidst ongoing challenges.

- Click here to discover the nuances of Daktronics with our detailed analytical valuation report.

Assess Daktronics' past performance with our detailed historical performance reports.

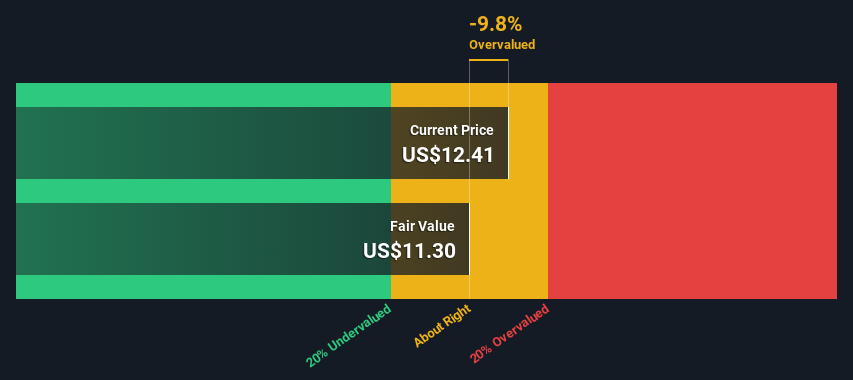

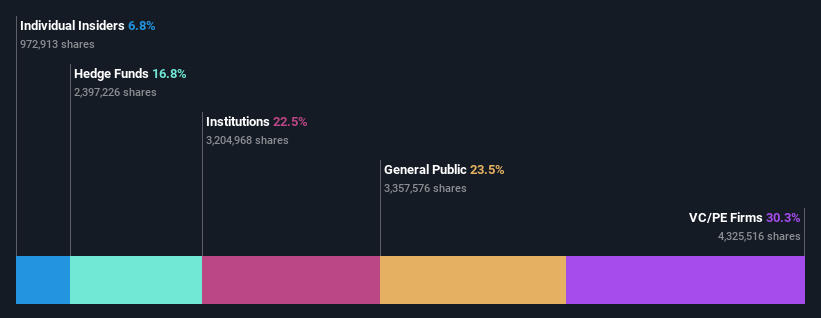

Armada Hoffler Properties (NYSE:AHH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Armada Hoffler Properties is a real estate company engaged in the development, construction, and management of office, retail, and multifamily properties with a market cap of approximately $1.54 billion.

Operations: The company's revenue is primarily driven by General Contracting and Real Estate Services, contributing significantly to its overall income. Operating expenses have shown an upward trend over the periods, impacting net income. Notably, the net profit margin has fluctuated over time, reaching a low of -1.92% and a high of 14.27%.

PE: 21.1x

Armada Hoffler Properties, a real estate firm with a notable presence in mixed-use developments, recently executed significant leases at The Interlock in Atlanta and Columbus Village in Virginia Beach. Despite earnings challenges forecasted to decline by 36% annually over the next three years, insider confidence is evident as A. Kirk purchased 50,000 shares for US$386,300. This purchase reflects potential optimism about the company's strategic positioning amidst its ongoing leasing success and diverse tenant mix across prime locations.

- Click to explore a detailed breakdown of our findings in Armada Hoffler Properties' valuation report.

Understand Armada Hoffler Properties' track record by examining our Past report.

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Global Indemnity Group is an insurance provider with operations primarily focused on specialty property and casualty insurance, and it has a market capitalization of approximately $0.37 billion.

Operations: Global Indemnity Group's revenue primarily stems from its Penn-America segment, with a smaller contribution from Non-core Operations. The company has faced fluctuations in its gross profit margin, which was 0.18% as of the latest period ending April 8, 2025. Operating expenses and non-operating expenses also play a significant role in shaping the company's net income outcomes over time.

PE: 10.0x

Global Indemnity Group, a smaller player in the insurance sector, has demonstrated resilience despite challenges. For 2024, they reported US$441.19 million in revenue and increased net income to US$43.24 million from the previous year’s US$25.43 million, reflecting improved profitability amid declining revenues. The company completed a significant reorganization under 'Project Manifest', enhancing operational efficiency and setting the stage for future growth. No recent insider confidence through share purchases was noted; however, strategic changes indicate potential value realization ahead.

- Take a closer look at Global Indemnity Group's potential here in our valuation report.

Explore historical data to track Global Indemnity Group's performance over time in our Past section.

Where To Now?

- Discover the full array of 73 Undervalued US Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com