Roper Technologies (NasdaqGS:ROP) recently experienced a 1.7% price increase over the last quarter. This period coincided with significant earnings growth, as the company reported increased sales and net income, alongside higher EPS compared to the previous year. Roper's decision to maintain its dividend and its pursuit of strategic M&A opportunities, with over $5 billion available for acquisitions, may have supported investor confidence. Despite the broader market's volatility due to trade tariffs that saw a 12% drop, Roper's strategic growth outlook and financial performance appeared to provide resilience amidst the challenging market environment.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Roper Technologies has demonstrated a 67.05% total shareholder return over a five-year period. This strong performance reflects the company's ability to capitalize on its strategic initiatives, such as maintaining dividends and pursuing M&A opportunities. In the context of the recent news regarding its earnings growth, Roper's stock price increase of 1.7% this past quarter aligns with its broader strategy to enhance shareholder value.

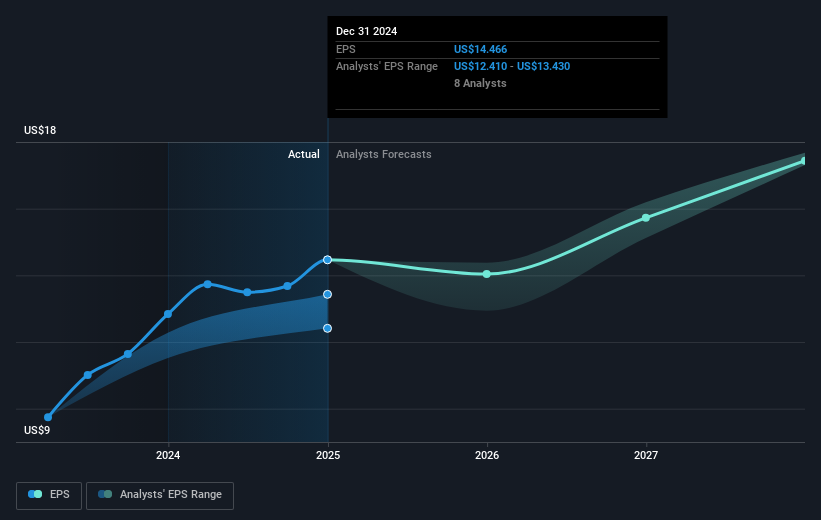

Relative to the market, Roper's stock performance has surpassed the US Software industry, which saw a 9.8% decline over the past year, underscoring the company's resilience. The integration of GenAI and an elevated focus on capital capabilities are anticipated to bolster revenue and earnings forecasts, with analysts projecting a 9.0% annual revenue growth over the next three years and expected earnings reaching US$1.9 billion by April 2028.

The current share price of US$590.78 shows a modest discount relative to the analyst consensus price target of US$630.09, suggesting limited upside potential based on the current valuation. Nonetheless, Roper's financial strategies, including the potential US$5 billion allocated for acquisitions, may contribute to sustained growth and influence future stock performance.

Review our growth performance report to gain insights into Roper Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com