In the most recent quarter, Automatic Data Processing (NasdaqGS:ADP) saw a price movement of 5%. The company's solid performance in terms of revenue and net income growth, as announced in its earnings report, might have provided some counterweight to broader market trends. The declaration of regular dividends may have lent support to its shares, demonstrating a commitment to shareholder value. Significant share buybacks further expressed confidence in the company's operations. These factors stood in contrast to the volatile market, accentuated by pressing trade tensions impacting sectors like technology and pharmaceuticals.

Automatic Data Processing's recent quarterly price movement of nearly 5% could potentially be influenced by its earnings report, which highlighted robust revenue and net income growth. This aligns with the company's narrative of enhancing its financial modules through partnerships and technological investments. Such collaborations, like the one with Fiserv, aim to augment payroll and HR services, potentially boosting future revenues and earnings. Over the last five years, ADP has delivered a total shareholder return of 113.67%, demonstrating a substantial long-term growth trajectory.

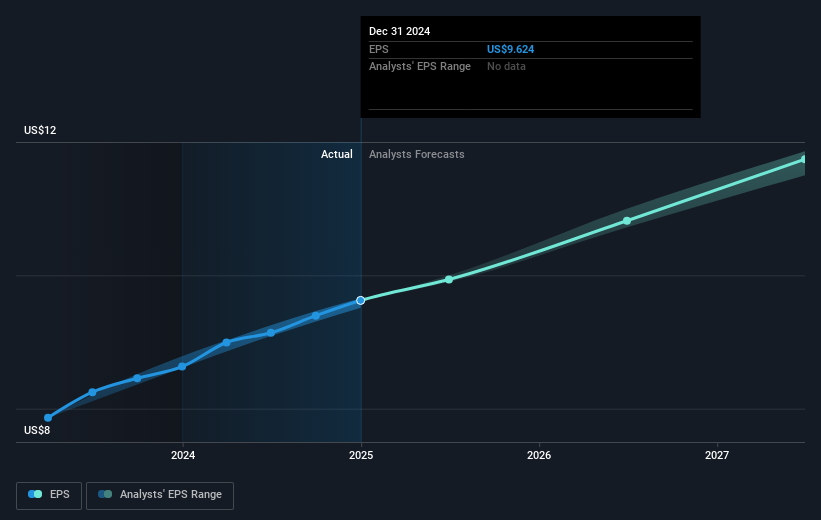

In comparison to the broader market, ADP's one-year returns have notably outpaced both the US Professional Services industry and the US market, which suffered declines of 5.6% and 5.8%, respectively. This indicates resilience amidst volatile conditions and suggests that its continued dividend payments and share buybacks provide a stabilizing effect. Looking ahead, the recent news could impact analysts' revenue forecasts, with potential revenue growth anticipated at around 5.8% annually, driven by expanding client offerings and enhanced efficiencies through AI investments.

The share price movement, while slightly lower than the consensus price target of US$309.94, reflects a narrow discount of about 0.12%. This small variance implies that investors and analysts may view ADP as reasonably priced, considering the company's robust strategies and stable industry position. Such insights are essential for shareholders evaluating future growth paths against current market conditions.

Explore Automatic Data Processing's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com