Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Aviat Networks, Inc. (NASDAQ:AVNW) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is Aviat Networks's Net Debt?

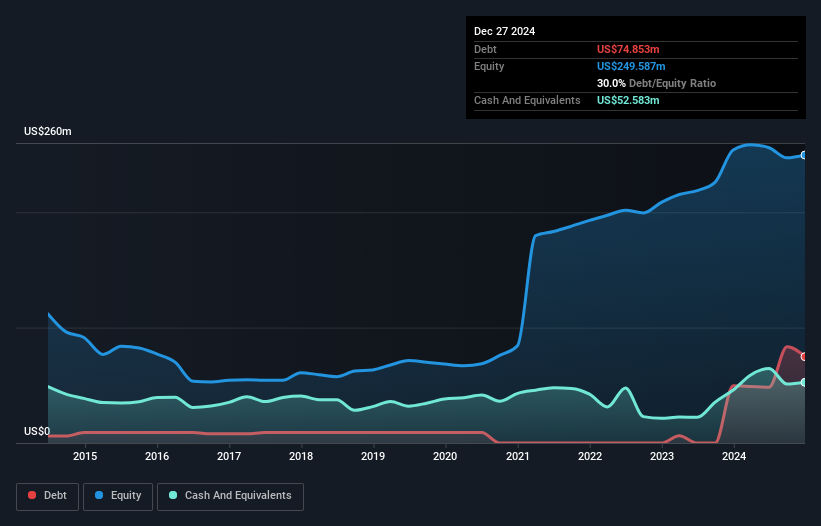

As you can see below, at the end of December 2024, Aviat Networks had US$74.9m of debt, up from US$49.5m a year ago. Click the image for more detail. However, it also had US$52.6m in cash, and so its net debt is US$22.3m.

How Strong Is Aviat Networks' Balance Sheet?

According to the last reported balance sheet, Aviat Networks had liabilities of US$252.3m due within 12 months, and liabilities of US$92.2m due beyond 12 months. Offsetting this, it had US$52.6m in cash and US$272.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$20.0m.

Given Aviat Networks has a market capitalization of US$212.8m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

View our latest analysis for Aviat Networks

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.1 and interest cover of 3.2 times, it seems to us that Aviat Networks is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, Aviat Networks's EBIT fell a jaw-dropping 38% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Aviat Networks can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Aviat Networks created free cash flow amounting to 16% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Aviat Networks's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Aviat Networks's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Aviat Networks insiders have sold any shares recently. You click here to find out if insiders have sold recently .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.