Fair Isaac (NYSE:FICO) experienced a 9% decline in its stock price over the past month. During this time, the company announced significant partnerships with Fujitsu Limited and Nationwide Building Society, as well as the release of its FICO® Score Mortgage Simulator. While these events individually underscored the company's strategic moves in expanding its financial services and technological offerings, they unfolded amidst a broader market downturn exacerbated by U.S. tariff implementations and ensuing trade tensions. The overall bearish trend in the market, marked by a 12% decline in the S&P 500, likely overshadowed these positive developments for Fair Isaac.

We've discovered 1 risk for Fair Isaac that you should be aware of before investing here.

Fair Isaac's recent partnerships with Fujitsu and Nationwide, coupled with its innovative FICO® Score Mortgage Simulator, highlight the company's efforts to enhance its product offerings. These initiatives have the potential to drive revenue and earnings by attracting more customers and expanding market reach. Despite a significant 9% decline in stock price over the past month amid broader market challenges due to trade tensions, the focus on expanding platform capabilities suggests a positive outlook for the company’s future performance.

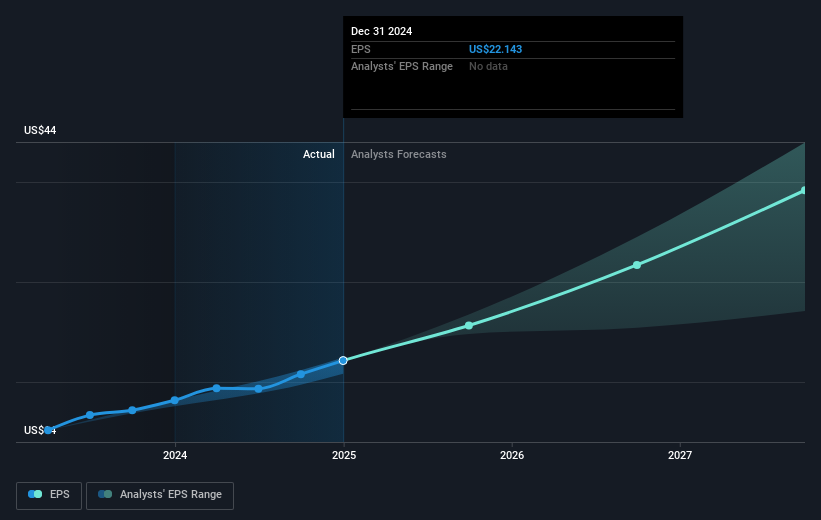

Over the past five years, Fair Isaac's total shareholder return soared by a very large percentage, reflecting strong long-term performance. However, comparing shorter periods, while Fair Isaac's shares exceeded the returns of the US market and its industry over the past year, the recent downturn in the stock has affected short-term gains. Nevertheless, analysts remain optimistic, setting a consensus price target of US$2040.57, which suggests an 8.4% potential upside from the current share price of US$1868.47.

The company's revenue is buoyed by growth in the Scores and Software segments, particularly with the adoption of FICO Score 10T, which could influence analyst forecasts positively. Although there is potential uncertainty due to factors like foreign exchange rate fluctuations and implementation delays, these expansions could outweigh short-term market pressures. Investors are encouraged to consider how these developments align with Fair Isaac's long-term growth potential while evaluating the current market conditions and analyst forecasts.

Learn about Fair Isaac's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com