FactSet Research Systems (NYSE:FDS) recently announced a significant credit agreement, introducing both term and revolving facilities, which may have contributed to its 9.5% price decline over the last month. This financial maneuver comes at a time when the Dow Jones is experiencing volatile trading amidst new tariffs, with significant impacts on various sectors. FactSet's actions, including debt refinancing and strategic adjustments, could be adding pressure in a turbulent market. Overall, these events might have amplified the stock's response to wider market trends, highlighted by a considerable 12% drop in broader indices.

We've identified 1 possible red flag for FactSet Research Systems that you should be aware of.

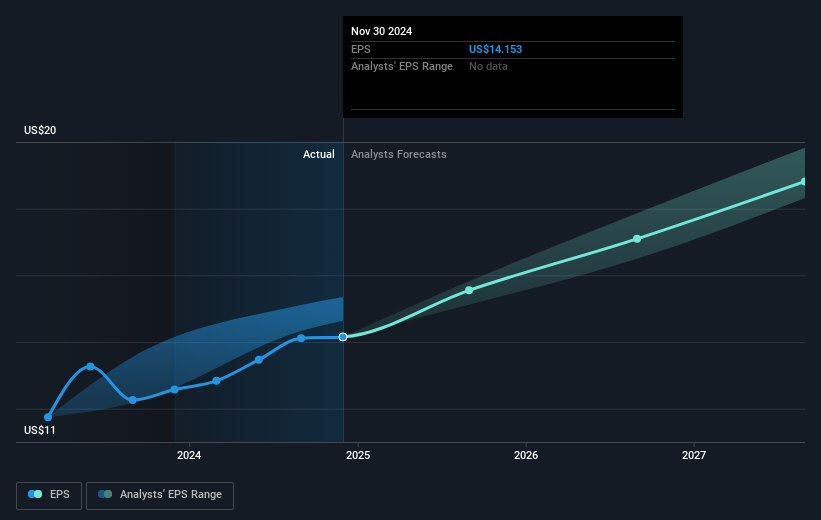

The recent credit agreement by FactSet Research Systems and its subsequent price decline may impact the company's future revenue and earnings forecasts. By introducing term and revolving facilities, FactSet aims to manage debt and support strategic growth initiatives. However, rising technology costs and asset management challenges are already pressing margins, which could further strain if macroeconomic pressures persist. Analysts anticipate a 5.8% annual revenue growth and a margin uptick to 26.7% in three years, but these targets could be affected if the company's new strategies don't counterbalance current cost pressures.

Over the past five years, FactSet's total shareholder return, which includes share price and dividends, was 49.5%. This indicates a robust return for long-term investors despite recent volatility. In contrast, the company's one-year performance, with a significant underperformance relative to both the broader US market's 3.8% decline and the US Capital Markets industry's 1.7% gain, reflects challenges in adapting to immediate market conditions. The current share price of US$457.01 shows a slight overvaluation of 2.7% compared to the consensus price target of US$444.81, suggesting that some investors might expect better prospects than analysts forecast. However, it’s crucial for investors to assess if the price aligns with their expectations of FactSet's ability to implement and benefit from its recent initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com