Broadridge Financial Solutions (NYSE:BR) recently completed a successful collaboration with Fnality and launched its Digital Asset Solutions, reflecting its innovative strides in the financial industry. Despite these promising advancements, the company's share price experienced a 5% decline last quarter. During this period, broader market volatility influenced by tariff announcements and economic uncertainty affected multiple sectors, including financial services. While Broadridge's initiatives could have provided a positive counterbalance, the prevailing downward trend in the market, with the broader market experiencing a 12% drop, likely exerted more significant influence on its share price performance.

You should learn about the 1 risk we've spotted with Broadridge Financial Solutions.

The recent partnership with Fnality and the launch of Digital Asset Solutions may bolster Broadridge Financial Solutions' technological capabilities in financial services. Considering Broadridge's track record, its share price appreciated 120.94% over the past five years, despite a 12-month performance that exceeded the US Professional Services industry's decline of 3.5%. This suggests resilience in Broadridge's business model and the potential for sustained growth through digital innovations, even amid short-term market challenges.

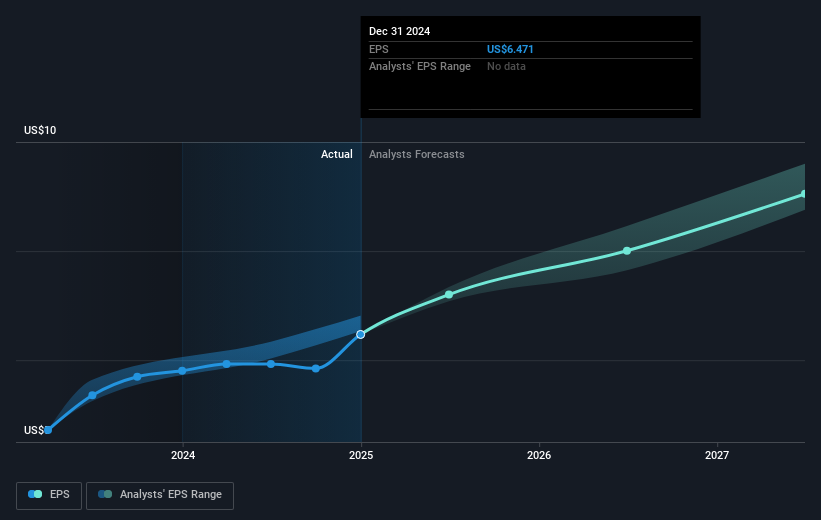

The ongoing investment in technology could foster long-term revenue and earnings growth, aligning with analysts' forecasts. Analysts currently project Broadridge's revenue to grow by 5.9% annually over the next three years, with an increase in profit margins from 11.4% to 14.2%. This suggests that the integration of digital solutions can enhance future earnings potential, supporting a US$1.1 billion earnings target by April 2028. With a current share price of US$244.72, close to the consensus price target of US$245.67, the market appears to factor in these growth prospects. Investors, however, should carefully evaluate these projections in the context of current market conditions and potential risks highlighted by analysts in arriving at their investment decisions.

Explore Broadridge Financial Solutions' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com