MINISO Group Holding (NYSE:MNSO) recently unveiled optimistic fiscal 2025 guidance amid a 25% weekly share price decline, despite strong quarterly results showing a 23% increase in net income year-on-year. The company's recent semi-annual dividend increase and share buyback update, including a significant tranche repurchase, bolster investor confidence but were unable to counteract the broader market downturn. The drop mirrors a 12% decline in the market linked to U.S.-China tariff tensions. Against this backdrop, the amendments in corporate governance and reported impairment losses were neutral, while corporate optimism provides a future growth narrative.

The recent developments concerning MINISO Group Holding, despite reporting strong quarterly results and fiscal 2025 guidance, have not managed to shield the company from share price volatility. The 25% weekly decline was notably influenced by broader market conditions like U.S.-China tariff tensions. This reduction puts the current share price at a noticeable discount compared to the analyst consensus price target of US$24.50. Investors might view this disparity as a potential buying opportunity depending on their risk tolerance and belief in the company's long-term growth potential.

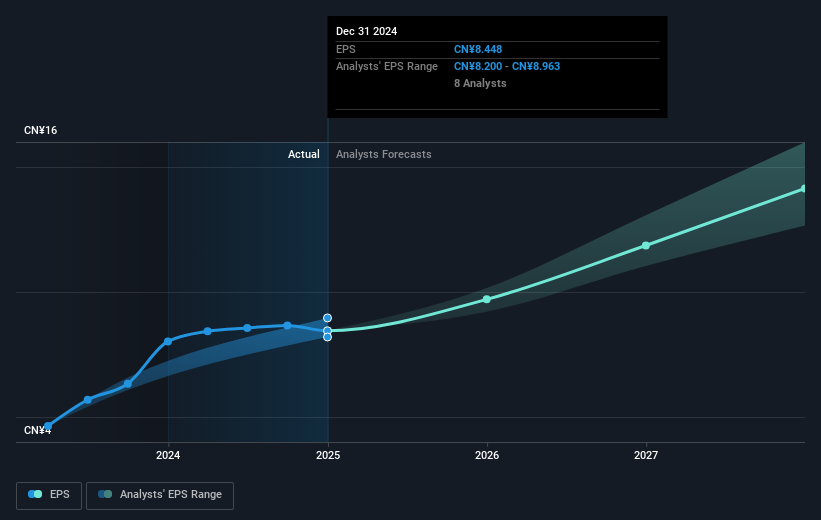

Over the past three years, MINISO's total shareholder return, including dividends, achieved an impressive 99.72% increase. However, over the past year, the company's share performance lagged behind the US Multiline Retail industry, which saw a 4.6% decline, indicating short-term challenges despite long-term gains. The recent news and strategic overseas expansion are expected to have a positive impact on future revenue and earnings forecasts, aligning with assumptions of annual revenue growth of 19.2% and an increase in profit margins from 15.4% to 16.1% by 2028. While the current market conditions present obstacles, the company's growth initiatives in new regions and diversified supply chain efforts are designed to counterbalance these setbacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com