5 analysts have shared their evaluations of Addus HomeCare (NASDAQ:ADUS) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

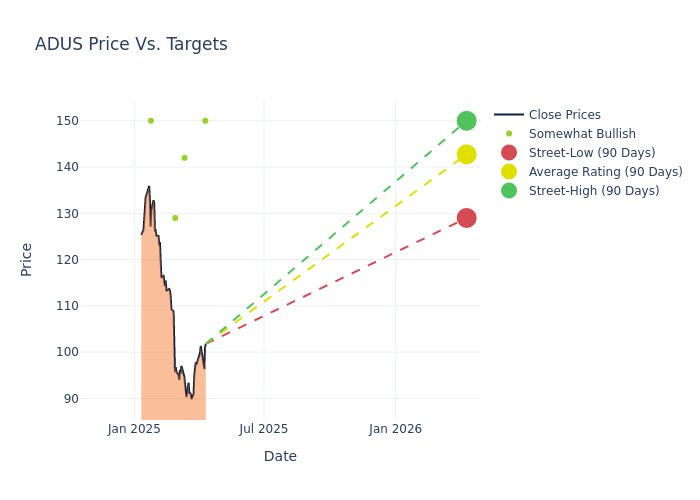

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $142.6, a high estimate of $150.00, and a low estimate of $129.00. Observing a downward trend, the current average is 0.83% lower than the prior average price target of $143.80.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Addus HomeCare is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|-----------------|--------------------|--------------------| |Constantine Davides |JMP Securities |Maintains |Market Outperform| $150.00|$150.00 | |Scott Fidel |Stephens & Co. |Maintains |Overweight | $142.00|$142.00 | |Tao Qiu |Macquarie |Maintains |Outperform | $129.00|$129.00 | |Raj Kumar |Stephens & Co. |Lowers |Overweight | $142.00|$153.00 | |Ari Wald |Oppenheimer |Raises |Outperform | $150.00|$145.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Addus HomeCare. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Addus HomeCare compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Addus HomeCare's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Addus HomeCare's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Addus HomeCare analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Addus HomeCare

Addus HomeCare Corp is engaged in the provision of in-home personal care services. It operates through the segments such as Personal care segment, which is a key revenue driver, provides non-medical assistance with activities of daily living, primarily to persons who are at risk of hospitalization or institutionalization, such as the elderly, chronically ill and disabled. The Hospice segment provides physical, emotional and spiritual care for people who are terminally ill and their families. Its Home health segment provides services that are primarily medical in nature to those individuals who may require assistance during an illness or after surgery.

A Deep Dive into Addus HomeCare's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Addus HomeCare's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 7.52%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Addus HomeCare's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.57%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Addus HomeCare's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.04%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Addus HomeCare's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.52%, the company showcases efficient use of assets and strong financial health.

Debt Management: Addus HomeCare's debt-to-equity ratio is below the industry average at 0.28, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.