As the U.S. stock market experiences significant volatility, with major indices like the Dow and Nasdaq seeing substantial swings, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or newer companies that can still offer promising investment opportunities. By focusing on those with strong financial health and potential for growth, investors might find valuable prospects among these lesser-known equities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.21 | $343.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.02 | $1.29B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.71 | $652.79M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7592 | $13.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.90 | $54.09M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.75 | $48.69M | ✅ 3 ⚠️ 3 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.36 | $71.89M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.7565 | $5.74M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $204.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $4.03 | $92.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 795 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aldeyra Therapeutics (NasdaqCM:ALDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on discovering and developing therapies for immune-mediated and metabolic diseases, with a market cap of $115.83 million.

Operations: Aldeyra Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $115.83M

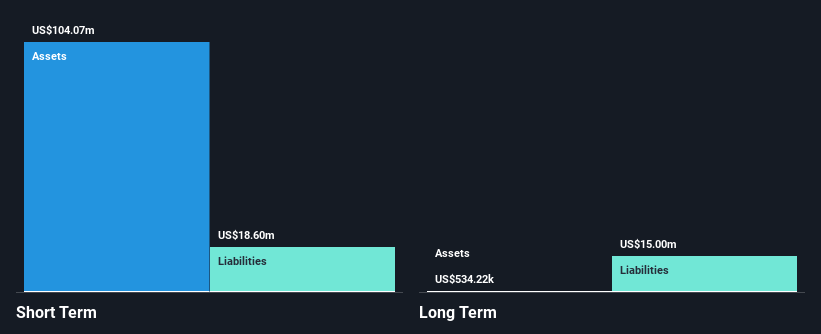

Aldeyra Therapeutics, Inc., with a market cap of US$115.83 million, is currently pre-revenue and unprofitable. The company recently received a Complete Response Letter from the FDA regarding its investigational drug reproxalap for dry eye disease, indicating the need for additional trials to demonstrate efficacy. Despite this setback, Aldeyra has sufficient cash runway exceeding one year and more cash than debt. Its short-term assets significantly surpass both short- and long-term liabilities. However, its share price remains highly volatile with increased weekly volatility over the past year, reflecting investor uncertainty amidst ongoing clinical developments.

- Dive into the specifics of Aldeyra Therapeutics here with our thorough balance sheet health report.

- Gain insights into Aldeyra Therapeutics' future direction by reviewing our growth report.

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vasta Platform Limited offers educational printed and digital solutions to private schools in Brazil's K-12 sector, with a market cap of $372.80 million.

Operations: The company generates revenue of R$1.67 billion from its Educational Services segment, specifically in Education & Training Services.

Market Cap: $372.8M

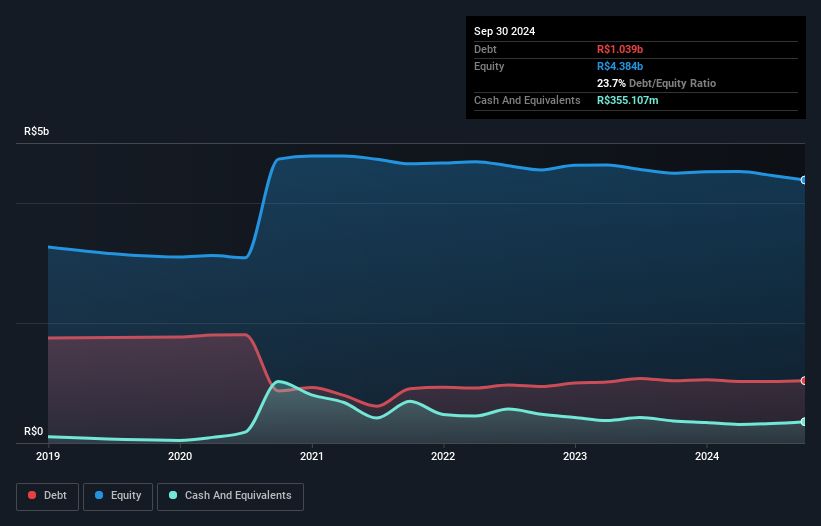

Vasta Platform Limited, with a market cap of $372.80 million, has shown significant financial improvement by becoming profitable in the last year, reporting a net income of R$486.49 million compared to a loss previously. Its revenue from educational services reached R$1.67 billion, demonstrating growth despite industry challenges. The company's debt management is satisfactory with reduced debt levels over five years and short-term assets exceeding liabilities. However, its earnings are forecasted to decline significantly over the next three years while revenue is expected to grow modestly by 10.7% per year, indicating potential volatility in financial performance moving forward.

- Get an in-depth perspective on Vasta Platform's performance by reading our balance sheet health report here.

- Assess Vasta Platform's future earnings estimates with our detailed growth reports.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of approximately $591.04 million.

Operations: The company generates revenue of $247.28 million from its Internet Information Providers segment.

Market Cap: $591.04M

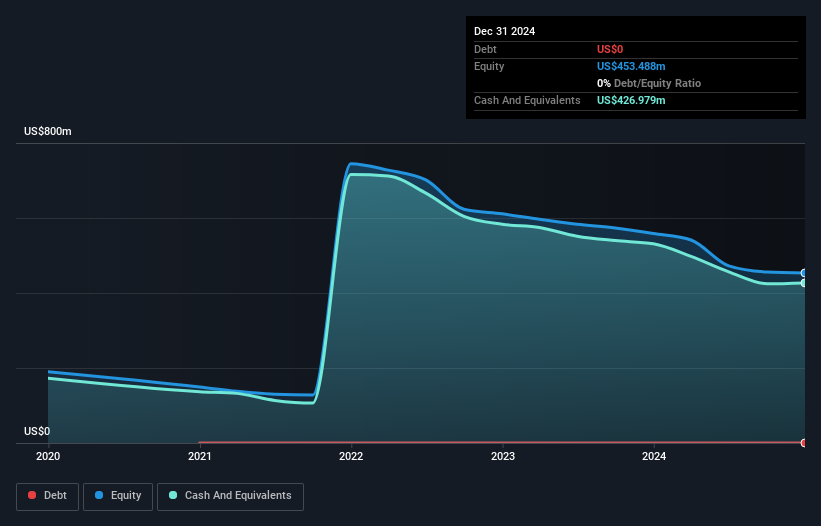

Nextdoor Holdings, with a market cap of US$591.04 million, remains unprofitable but has shown improvement by reducing its net loss from US$147.77 million to US$98.06 million year-over-year while generating revenue of US$247.28 million in 2024. The company is debt-free and has a strong cash position, covering both short and long-term liabilities with assets totaling US$466.7 million against liabilities of US$60.4 million combined. Recent partnerships like the one with Class Intercom aim to leverage its platform's reach among 45 million weekly active users, potentially expanding its user engagement and advertising opportunities further despite current financial challenges.

- Click to explore a detailed breakdown of our findings in Nextdoor Holdings' financial health report.

- Explore Nextdoor Holdings' analyst forecasts in our growth report.

Next Steps

- Explore the 795 names from our US Penny Stocks screener here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com