Quanta Services (NYSE:PWR) announced a quarterly cash dividend of $0.10 per share, underlining its commitment to shareholder returns. Over the past week, the company’s stock price increased by 13%, outperforming the broader market, which rose by 5%. This positive movement could reflect investor confidence spurred by the company's proactive dividend policy. While the market is projected to see earnings growth of 14% annually, Quanta Services’ recent announcement added a favorable sentiment, contributing to the stock's impressive weekly performance amidst broader market optimism.

We've identified 1 risk for Quanta Services that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

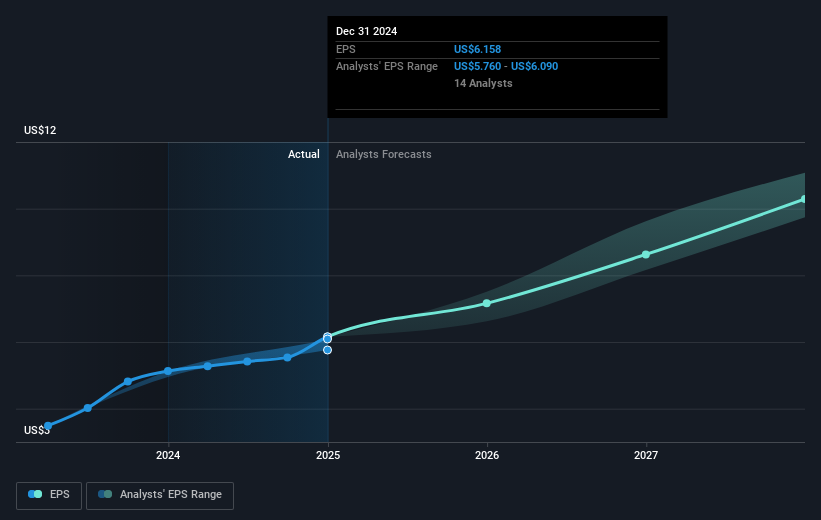

The announcement of Quanta Services' quarterly cash dividend could have implications for its revenue and earnings forecasts. By reinforcing its commitment to shareholder returns, Quanta may enhance investor confidence, potentially leading to increased demand for its stock. This confidence is reflected in the company's impressive 13% stock price rise over the past week, significantly outperforming the broader market's 5% gain. Analyst predictions of 12.3% annual revenue growth over the next three years may see further support if the dividend policy positively influences investor psychology and market sentiment.

Over the past five years, Quanta Services has achieved a total return of over 680%, pointing to strong long-term performance and alignment with its strategic initiatives, including expanding service lines. This past performance provides context for today's positive news and price movements. Notably, over the previous year, Quanta's earnings growth of 21.5% exceeded the construction industry's 20.1% growth rate, indicating a favorable position within its sector.

With Quanta's current share price at US$245.05 and analysts' consensus price target set at approximately US$329.29, the current valuation reflects a 21.6% expected increase. This suggests a potential for further price gains if the company's growth prospects align with analyst expectations. The dividend announcement could act as a catalyst, influencing perceptions about Quanta's revenue and profitability trajectory. Investors should remain vigilant in assessing whether the company's operational and strategic developments support the anticipated growth in revenue to US$33.5 billion and earnings to US$1.5 billion by 2028.

Dive into the specifics of Quanta Services here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com