The Purple Innovation, Inc. (NASDAQ:PRPL) share price has fared very poorly over the last month, falling by a substantial 27%. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

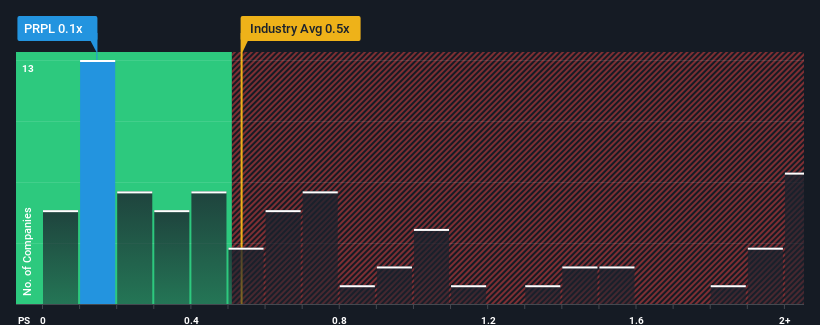

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Purple Innovation's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Purple Innovation

What Does Purple Innovation's P/S Mean For Shareholders?

Purple Innovation hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Purple Innovation .How Is Purple Innovation's Revenue Growth Trending?

Purple Innovation's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.4%. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 3.0% per year over the next three years. That's shaping up to be materially lower than the 6.2% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Purple Innovation's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

With its share price dropping off a cliff, the P/S for Purple Innovation looks to be in line with the rest of the Consumer Durables industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Purple Innovation's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Purple Innovation that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.