Providing a diverse range of perspectives from bullish to bearish, 13 analysts have published ratings on Ferguson Enterprises (NYSE:FERG) in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 11 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 5 | 1 | 0 | 0 |

| 3M Ago | 0 | 3 | 0 | 0 | 0 |

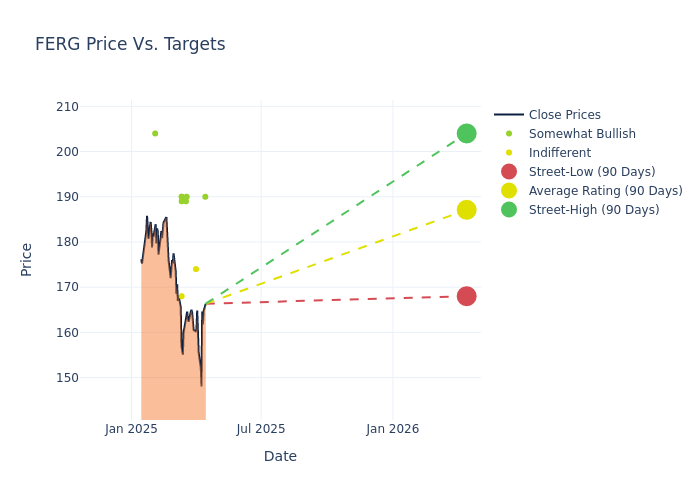

The 12-month price targets, analyzed by analysts, offer insights with an average target of $189.92, a high estimate of $211.00, and a low estimate of $168.00. Observing a downward trend, the current average is 9.09% lower than the prior average price target of $208.91.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Ferguson Enterprises. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Sam Reid |Wells Fargo |Raises |Overweight | $190.00|$180.00 | |Collin Verron |Deutsche Bank |Announces |Hold | $174.00|- | |Patrick Baumann |JP Morgan |Lowers |Overweight | $190.00|$205.00 | |Mike Dahl |RBC Capital |Maintains |Outperform | $189.00|$189.00 | |Anthony Pettinari |Citigroup |Lowers |Neutral | $168.00|$189.00 | |Mike Dahl |RBC Capital |Lowers |Outperform | $189.00|$211.00 | |Sam Reid |Wells Fargo |Lowers |Overweight | $180.00|$205.00 | |Scott Schneeberger |Oppenheimer |Lowers |Outperform | $189.00|$234.00 | |Matthew Bouley |Barclays |Lowers |Overweight | $190.00|$211.00 | |David Manthey |Baird |Lowers |Outperform | $190.00|$225.00 | |Sam Reid |Wells Fargo |Lowers |Overweight | $205.00|$215.00 | |Annelies Vermeulen |Morgan Stanley |Announces |Overweight | $204.00|- | |Matthew Bouley |Barclays |Lowers |Overweight | $211.00|$234.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ferguson Enterprises. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ferguson Enterprises compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Ferguson Enterprises's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Ferguson Enterprises's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Ferguson Enterprises analyst ratings.

All You Need to Know About Ferguson Enterprises

Ferguson distributes plumbing and HVAC products to North American repair, maintenance and improvement, new construction, and civil infrastructure markets. It serves over 1 million customers and sources products from 36,000 suppliers. Ferguson engages customers through approximately 1,800 North American branches, over the phone, online, and in residential showrooms. According to Modern Distribution Management, Ferguson is the largest plumbing distributor and second-largest HVAC distributor (next to Watsco) in North America. The firm sold its UK business in 2021 and is now solely focused on the North American market.

Unraveling the Financial Story of Ferguson Enterprises

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Ferguson Enterprises's remarkable performance in 3M is evident. As of 31 January, 2025, the company achieved an impressive revenue growth rate of 2.98%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Ferguson Enterprises's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 4.02%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ferguson Enterprises's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 4.95%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Ferguson Enterprises's ROA stands out, surpassing industry averages. With an impressive ROA of 1.65%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 1.1, Ferguson Enterprises adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.