Analysts' ratings for Westlake (NYSE:WLK) over the last quarter vary from bullish to bearish, as provided by 16 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 4 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 3 | 4 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

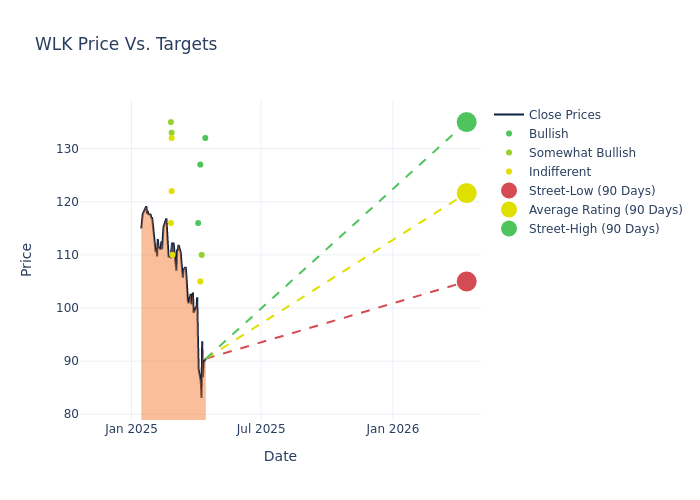

The 12-month price targets, analyzed by analysts, offer insights with an average target of $129.81, a high estimate of $168.00, and a low estimate of $105.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 10.92%.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Westlake's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Peter Osterland |Truist Securities |Lowers |Buy | $132.00|$155.00 | |Michael Sison |Wells Fargo |Lowers |Overweight | $110.00|$130.00 | |Joshua Spector |UBS |Lowers |Buy | $127.00|$144.00 | |Charles Neivert |Piper Sandler |Lowers |Neutral | $105.00|$120.00 | |Patrick Cunningham |Citigroup |Lowers |Buy | $116.00|$130.00 | |Peter Osterland |Truist Securities |Lowers |Buy | $155.00|$166.00 | |Charles Neivert |Piper Sandler |Lowers |Neutral | $120.00|$135.00 | |Jeffrey Zekauskas |JP Morgan |Lowers |Neutral | $110.00|$135.00 | |Arun Viswanathan |RBC Capital |Lowers |Outperform | $133.00|$147.00 | |Neel Kumar |Morgan Stanley |Lowers |Equal-Weight | $122.00|$130.00 | |John McNulty |BMO Capital |Lowers |Market Perform | $132.00|$157.00 | |Peter Osterland |Truist Securities |Lowers |Buy | $166.00|$168.00 | |Michael Sison |Wells Fargo |Lowers |Overweight | $130.00|$160.00 | |Steve Byrne |B of A Securities |Lowers |Neutral | $116.00|$134.00 | |Michael Leithead |Barclays |Lowers |Overweight | $135.00|$175.00 | |Peter Osterland |Truist Securities |Announces |Buy | $168.00|- |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Westlake. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Westlake compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Westlake's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Westlake's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Westlake analyst ratings.

Discovering Westlake: A Closer Look

Westlake Corp is a manufacturer and supplier of chemicals, polymers, and building products. Its Performance and Essential Materials segment offers a wide range of essential building blocks for making products utilized in everyday living, including olefins, vinyl chemicals, polyethylene, and epoxies. Its Housing and Infrastructure Products segment produces key finished goods for building products, pipe and fittings, and global compounds businesses.

Financial Insights: Westlake

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Westlake's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 0.6%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Westlake's net margin is impressive, surpassing industry averages. With a net margin of 0.25%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Westlake's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.07%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Westlake's ROA excels beyond industry benchmarks, reaching 0.03%. This signifies efficient management of assets and strong financial health.

Debt Management: Westlake's debt-to-equity ratio is below the industry average. With a ratio of 0.5, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.