Analysts' ratings for MeridianLink (NYSE:MLNK) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 2 | 3 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 1 | 0 |

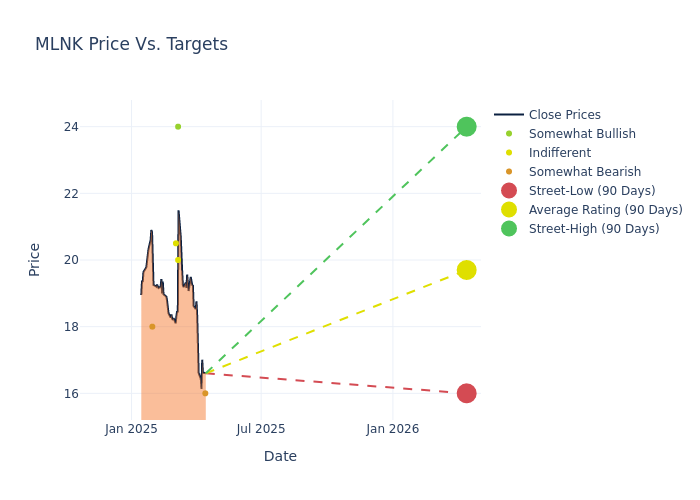

Analysts have set 12-month price targets for MeridianLink, revealing an average target of $19.58, a high estimate of $24.00, and a low estimate of $16.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 18.69%.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive MeridianLink is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Saket Kalia |Barclays |Lowers |Underweight | $16.00|$19.00 | |Andrew Schmidt |Citigroup |Lowers |Neutral | $20.00|$24.00 | |Alexander Sklar |Raymond James |Lowers |Outperform | $24.00|$28.00 | |Saket Kalia |Barclays |Lowers |Underweight | $19.00|$20.00 | |Nik Cremo |UBS |Lowers |Neutral | $20.50|$25.50 | |Koji Ikeda |B of A Securities |Lowers |Underperform | $18.00|$28.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to MeridianLink. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of MeridianLink compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of MeridianLink's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on MeridianLink analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About MeridianLink

MeridianLink Inc is a cloud-based software solution for financial institutions, including banks, credit unions, mortgage lenders, specialty lending providers, and consumer reporting agencies. It generates maximum revenue from Lending Software Solutions.

MeridianLink: A Financial Overview

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining MeridianLink's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.51% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: MeridianLink's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -9.75% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): MeridianLink's ROE excels beyond industry benchmarks, reaching -1.83%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): MeridianLink's ROA excels beyond industry benchmarks, reaching -0.8%. This signifies efficient management of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 1.1, MeridianLink faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.