The United States market has experienced a robust upswing, climbing 6.8% in the past week and showing a 5.9% increase over the last year, with all sectors contributing to this positive momentum and earnings projected to grow by 14% annually. In such an environment, identifying small-cap stocks that are perceived as undervalued and have insider buying activity can be particularly appealing for investors seeking opportunities aligned with these growth trends.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.7x | 3.3x | 48.47% | ★★★★★★ |

| Shore Bancshares | 9.2x | 2.0x | 18.91% | ★★★★★☆ |

| MVB Financial | 10.2x | 1.4x | 40.06% | ★★★★★☆ |

| Flowco Holdings | 6.1x | 0.9x | 40.41% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 31.22% | ★★★★★☆ |

| Columbus McKinnon | 41.2x | 0.4x | 44.45% | ★★★☆☆☆ |

| PDF Solutions | 173.1x | 3.9x | 22.38% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -8.00% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3297.93% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -325.08% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

ProFrac Holding (NasdaqGS:ACDC)

Simply Wall St Value Rating: ★★★★★★

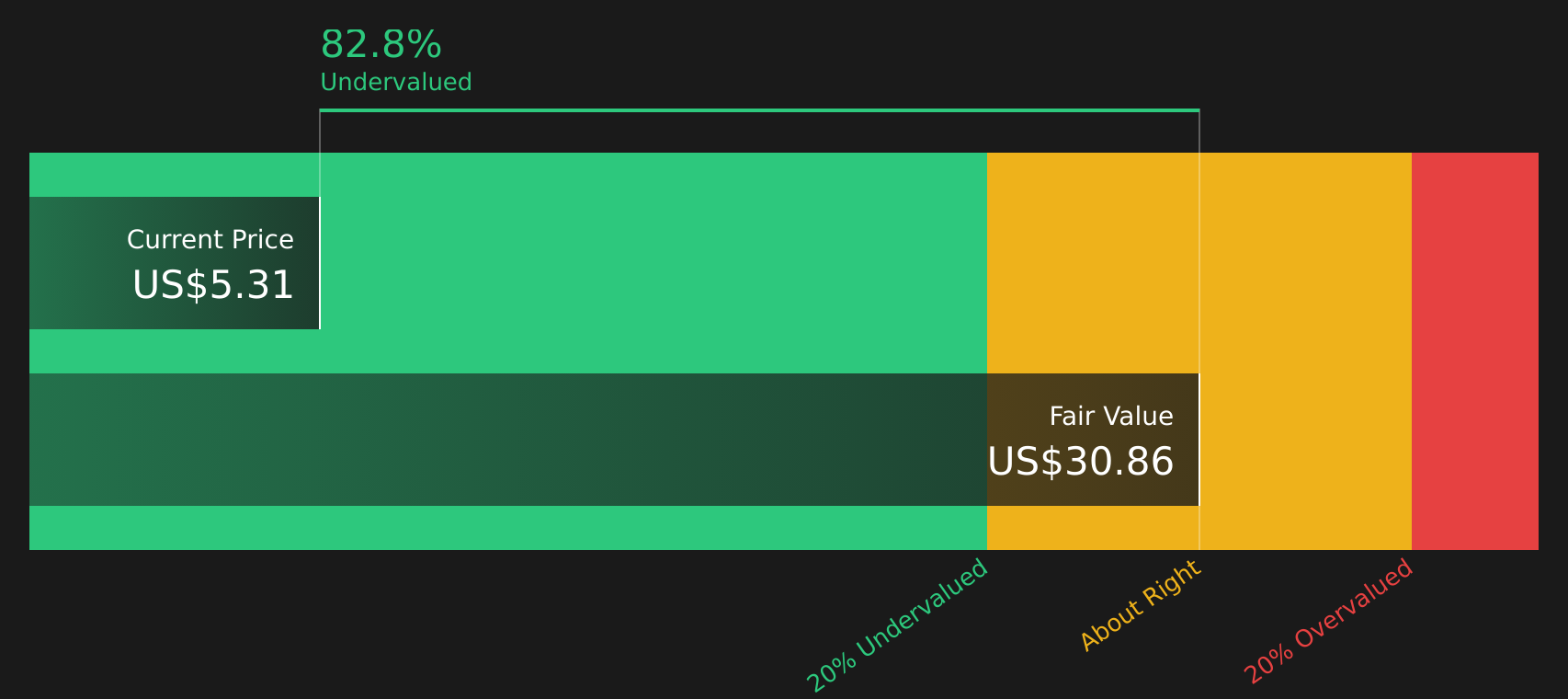

Overview: ProFrac Holding operates in the oil and gas industry, providing stimulation services, proppant production, and manufacturing with a focus on enhancing extraction processes; the company has a market capitalization of $2.03 billion.

Operations: The company generates revenue primarily from Stimulation Services, Proppant Production, and Manufacturing segments. Over recent periods, the gross profit margin has shown variability, reaching a high of 40.50% in early 2023 before declining to 31.76% by the end of 2024.

PE: -3.5x

ProFrac Holding, a smaller player in the market, is currently navigating financial challenges with a notable net loss of US$215.1 million for 2024. Despite this, insider confidence is evident as Johnathan Wilks purchased 338,756 shares for approximately US$2.3 million, indicating potential optimism about future prospects. The company forecasts improved revenues and profitability in Q1 2025 compared to Q4 2024, driven by increased activity levels. However, its reliance on external borrowing highlights funding risks amidst share price volatility over the past three months.

- Click to explore a detailed breakdown of our findings in ProFrac Holding's valuation report.

Examine ProFrac Holding's past performance report to understand how it has performed in the past.

Sinclair (NasdaqGS:SBGI)

Simply Wall St Value Rating: ★★★☆☆☆

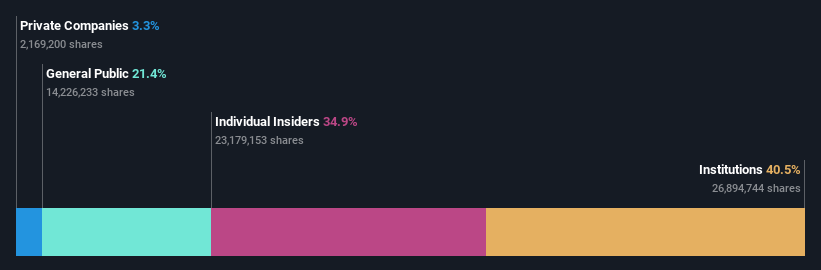

Overview: Sinclair is a diversified media company primarily engaged in local news broadcasting and sports programming, with a market cap of approximately $0.78 billion.

Operations: Sinclair's revenue is primarily driven by its Local Media segment, contributing significantly to its overall financial performance. The company's gross profit margin has shown variability, with a notable peak at 54.55% and a low of 34.40% across the periods analyzed. Operating expenses are substantial, with General & Administrative expenses being a major component.

PE: 3.1x

Sinclair, a prominent player in the media industry, is exploring new growth avenues with its strategic entry into the media-for-equity space. This initiative leverages Sinclair's vast media assets to support high-potential companies and emerging brands. Despite facing declining earnings projections over the next three years, Sinclair reported a revenue increase to US$3.55 billion for 2024 from US$3.13 billion in 2023, indicating operational resilience. Additionally, insider confidence is reflected through recent share purchases by executives within the company.

NexPoint Residential Trust (NYSE:NXRT)

Simply Wall St Value Rating: ★★★★☆☆

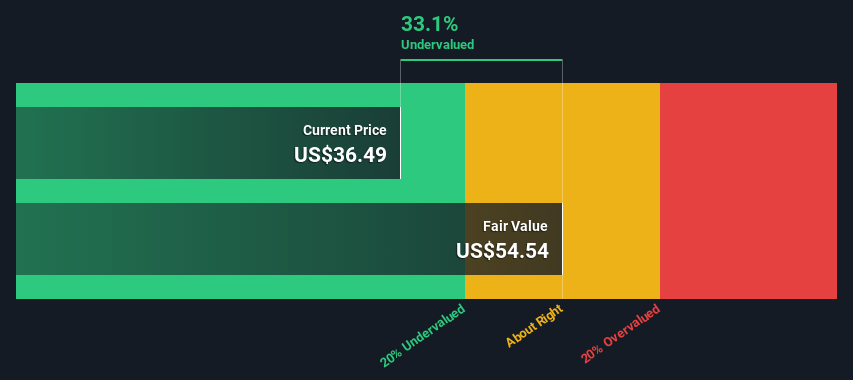

Overview: NexPoint Residential Trust focuses on acquiring, owning, and operating multifamily properties primarily in the Southeastern and Southwestern United States, with a market capitalization of approximately $1.3 billion.

Operations: The primary revenue stream comes from investments in real estate, generating $259.87 million. The cost of goods sold stands at $102.64 million, contributing to a gross profit margin of 60.50%. Operating expenses, including general and administrative costs, amount to $126.36 million. Net income is recorded at $1.11 million with a net income margin of 0.43%.

PE: 821.2x

NexPoint Residential Trust, a smaller player in the market, recently reported a challenging financial year with sales dropping to US$251.86 million and net income plummeting to US$1.11 million. Despite these setbacks, insider confidence is evident through share purchases over recent months. The company anticipates a net loss for 2025 but maintains its quarterly dividend of US$0.51 per share, suggesting resilience amidst external borrowing risks and declining earnings forecasts for the next three years.

- Unlock comprehensive insights into our analysis of NexPoint Residential Trust stock in this valuation report.

Understand NexPoint Residential Trust's track record by examining our Past report.

Seize The Opportunity

- Discover the full array of 81 Undervalued US Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com