Monolithic Power Systems (NasdaqGS:MPWR) experienced a price increase of 10% over the past week, closely aligned with positive movements in the tech sector, buoyed by recent exemptions in tech tariffs that likely elevated market sentiment. The company's recent amendments to the bylaws, which enhance stockholder rights and clarify governance structures, coincided with this rise, potentially adding weight to the broader market trends. As the market benefited from a general uptick in tech stocks, Monolithic Power's gains reflected both internal governance improvements and external positive tech sector momentum.

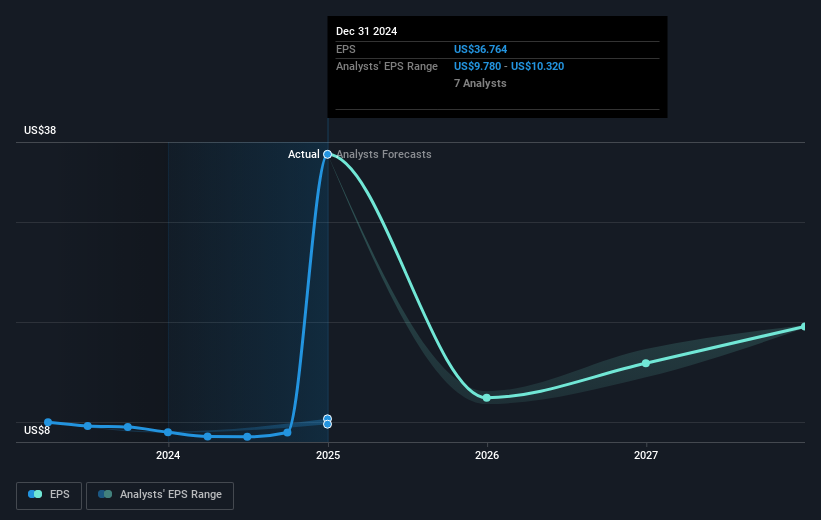

The recent 10% rise in Monolithic Power Systems' shares, following tariff exemptions in the tech sector and amendments to its bylaws, reflects possible positive revenue implications. By enhancing stockholder rights, the company may fortify investor confidence, potentially stabilizing market expectations about forthcoming revenue from product diversification in silicon carbide applications and automotive innovations. These developments could bolster the company's revenue and earnings forecasts, which include a projected revenue growth of 13.75% per year.

Monolithic Power's total shareholder return, consisting of share price appreciation and dividends, reached 203.21% over the last five years, demonstrating significant long-term investor gains. However, comparing one-year performance, the company underperformed the Semiconductor industry's 6.1% return. The current share price of US$455.19 represents a 44.1% discount to the analyst consensus price target of US$814.17, suggesting potential upside if the company's strategic initiatives materialize into the anticipated revenue and earnings growth. This provides a context for evaluating its market position and forthcoming earnings outlook, even as short-term performance trends vary.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com