10 analysts have shared their evaluations of Terreno Realty (NYSE:TRNO) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 2 | 2 | 0 | 0 |

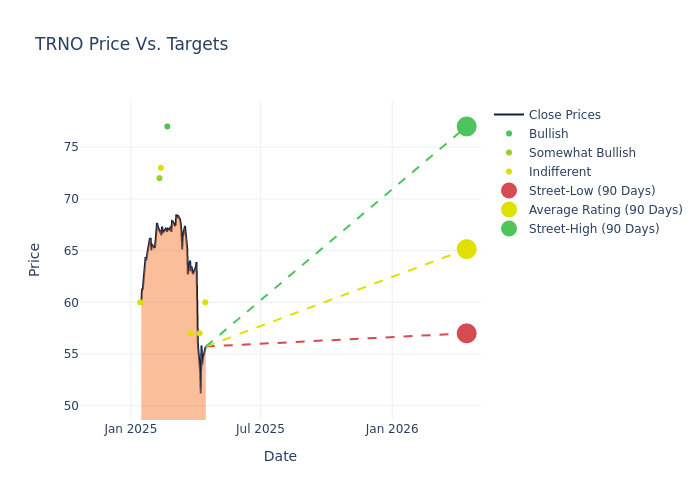

Insights from analysts' 12-month price targets are revealed, presenting an average target of $67.4, a high estimate of $78.00, and a low estimate of $57.00. A decline of 2.01% from the prior average price target is evident in the current average.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Terreno Realty among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|-----------------|--------------------|--------------------| |Alexander Goldfarb |Piper Sandler |Lowers |Neutral | $60.00|$61.00 | |Greg McGinniss |Scotiabank |Lowers |Sector Perform | $57.00|$68.00 | |Alexander Goldfarb |Piper Sandler |Lowers |Neutral | $61.00|$78.00 | |Brendan Lynch |Barclays |Lowers |Equal-Weight | $57.00|$60.00 | |Greg McGinniss |Scotiabank |Raises |Sector Perform | $68.00|$64.00 | |Caitlin Burrows |Goldman Sachs |Raises |Buy | $77.00|$65.00 | |John Kim |BMO Capital |Raises |Market Perform | $73.00|$71.00 | |Mitch Germain |JMP Securities |Maintains |Market Outperform| $72.00|$72.00 | |Alexander Goldfarb |Piper Sandler |Lowers |Overweight | $78.00|$80.00 | |John Kim |BMO Capital |Announces |Market Perform | $71.00|- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Terreno Realty. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Terreno Realty compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Terreno Realty's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Terreno Realty's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Terreno Realty analyst ratings.

About Terreno Realty

Terreno Realty Corp is a real estate investment trust engaged in acquiring, owning, and operating industrial real estate in six coastal U.S. markets: Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami, and Washington, D.C. The company invests in several types of industrial real estate, including warehouse/distribution, flex (including light industrial and research and development), transshipment, and improved land.

A Deep Dive into Terreno Realty's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Terreno Realty's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 19.92%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Terreno Realty's net margin excels beyond industry benchmarks, reaching 73.07%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Terreno Realty's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.08%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Terreno Realty's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.62%, the company showcases efficient use of assets and strong financial health.

Debt Management: Terreno Realty's debt-to-equity ratio is below the industry average. With a ratio of 0.22, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.