Throughout the last three months, 9 analysts have evaluated Huntsman (NYSE:HUN), offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 4 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 0 | 2 | 1 | 0 | 1 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

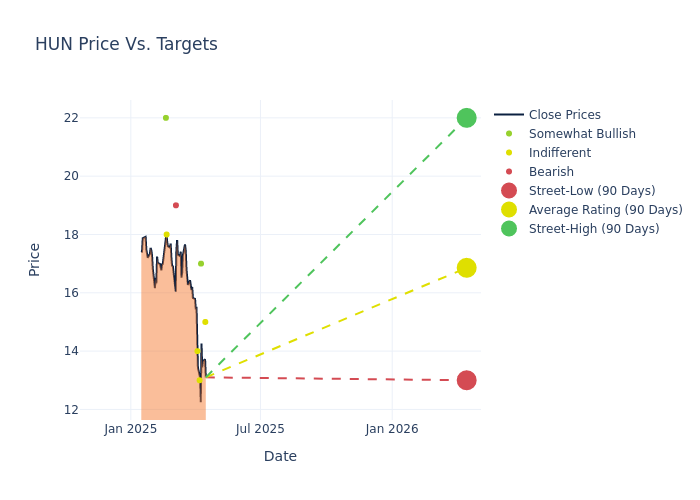

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $17.78, along with a high estimate of $22.00 and a low estimate of $13.00. A 15.77% drop is evident in the current average compared to the previous average price target of $21.11.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Huntsman. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Steve Byrne |B of A Securities |Lowers |Neutral | $15.00|$22.00 | |Michael Sison |Wells Fargo |Lowers |Overweight | $17.00|$20.00 | |Joshua Spector |UBS |Lowers |Neutral | $13.00|$18.00 | |Patrick Cunningham |Citigroup |Lowers |Neutral | $14.00|$19.00 | |Michael Sison |Wells Fargo |Lowers |Overweight | $20.00|$22.00 | |Duffy Fischer |Goldman Sachs |Lowers |Sell | $19.00|$22.00 | |Arun Viswanathan |RBC Capital |Raises |Sector Perform | $18.00|$17.00 | |Jeffrey Zekauskas |JP Morgan |Lowers |Overweight | $22.00|$25.00 | |Michael Sison |Wells Fargo |Lowers |Overweight | $22.00|$25.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Huntsman. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Huntsman compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Huntsman's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Huntsman's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Huntsman analyst ratings.

Delving into Huntsman's Background

Huntsman Corp is a USA-based manufacturer of differentiated organic chemical products. Its product portfolio comprises Methyl diphenyl diisocyanate (MDI), Amines, Maleic anhydride, and Epoxy-based polymer formulations. The company's products are used in adhesives, aerospace, automotive, and construction products, among others. Its operating segments are Polyurethanes, Performance Products, and Advanced Materials. It derives the majority of its revenue from the Polyurethanes segment,t which includes MDI, polyols, TPU (thermoplastic polyurethane), and other polyurethane-related products. Its geographical segments are the United States & Canada, Europe, Asia-Pacific, and the Rest of the world.

Unraveling the Financial Story of Huntsman

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, Huntsman showcased positive performance, achieving a revenue growth rate of 3.49% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Huntsman's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -9.71%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Huntsman's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -4.64%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Huntsman's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -1.95%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.76, Huntsman adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.