Kohl's (NYSE:KSS) experienced significant turbulence last week with its share price dropping 21%, a much sharper decline compared to the broader market's 3% fall. The departure of Siobhán Mc Feeney, the Chief Technology and Digital Officer, from the company on April 2 could have influenced this considerable downturn, signaling potential instability or transitional challenges within its leadership team. In contrast, major market indexes showed mixed results, with the S&P 500 gaining while the Dow Jones fell due to unrelated factors affecting companies like UnitedHealth. This leadership change at Kohl's may have amplified investor concerns amidst general market volatility.

The recent departure of Siobhán Mc Feeney and subsequent 21% drop in Kohl's share price last week has raised substantial investor concerns about the company's leadership stability and strategic direction. While this event may emphasize short-term volatility, it's crucial to consider the longer-term context. Over the past five years, the company's total shareholder return, including share price and dividends, fell by a substantial 47.56%. This decline starkly contrasts with the broader market's one-year return, which outperformed Kohl's.

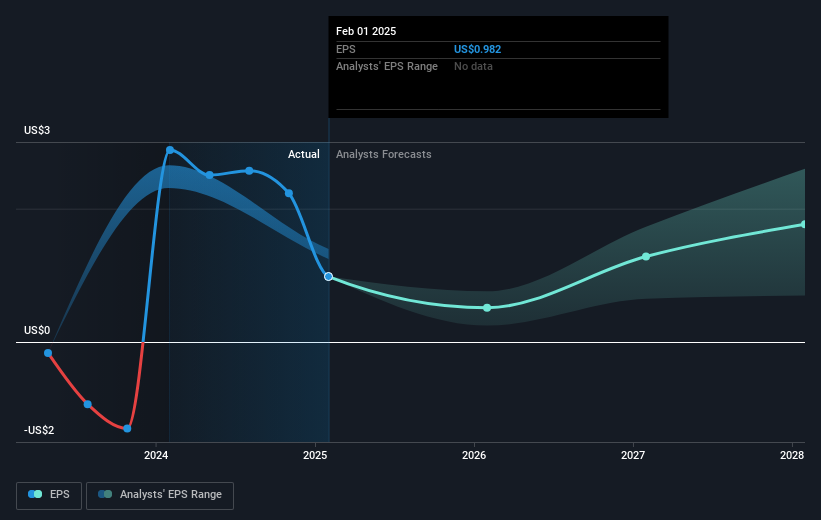

The leadership shake-up could have significant implications for revenue and earnings forecasts. Analysts predict a 4.9% annual decrease in revenue over the next three years, while profit margins are expected to gradually improve from 0.7% to 1.7%. While the company's refocused merchandise strategy and omnichannel enhancements aim to reverse these trends, any disruption in management could hinder these efforts. This uncertainty also has repercussions on analysts’ consensus price target of US$10.60, which remains 41.7% higher than the current share price of US$6.18, reflecting potential investor skepticism about achieving the projected outcomes.

Examine Kohl's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com