J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) trades higher Thursday. This comes after a lackluster earnings report. First quarter earnings per share came in at $1.17, while analysts were looking for $1.19.

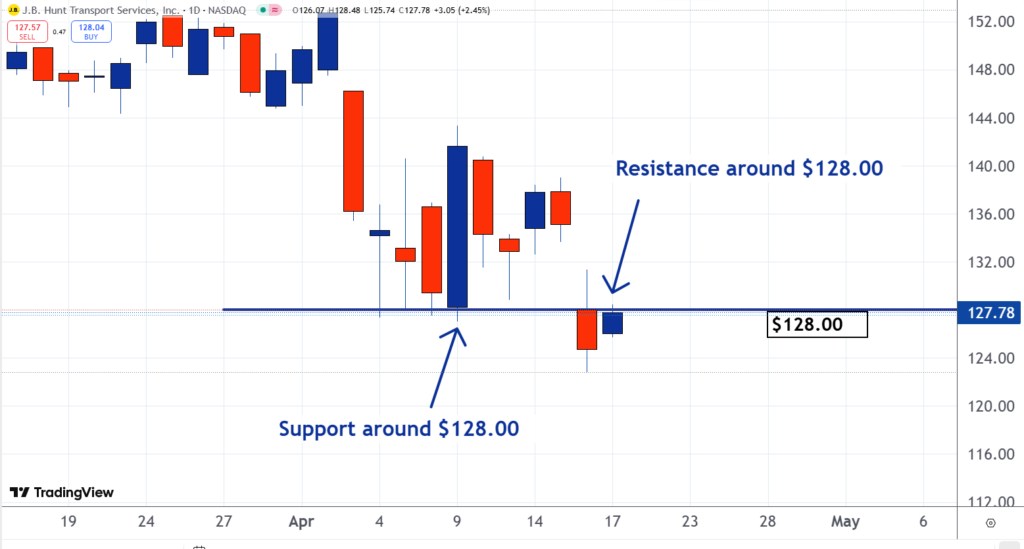

Traders are watching how the stock reacts around the important $128.00 level. Two weeks ago it was support. Now it is resistance. This is why it is our Stock of the Day.

Most volume for a stock typically trades at the opening and closing prices. This is why short-term traders need to know where these levels have recently been in their stocks. Because a lot of volume trades at these prices, they can become support and resistance levels.

Previous highs and lows on a day can be important as well. This isn't because heavy volume typically trades at them. It's more due to investor and trader psychology.

As you can see on the chart below, the low trades on Friday, April 4, Monday, April 7, Tuesday, April 8, and Friday, April 11 were close to $128. The opening price on Wednesday, April 9 was $128.22.

Now that the stock has dropped below $128, many traders and investors who bought it around this price regret doing so. Some decide to sell if they can get out at breakeven.

They placed sell orders at or around $128. This is why there was resistance there yesterday. It was the opening price, and then the shares sold off over the course of the day and closed almost four points lower. And as for now, they seem to have found resistance there again in Thursday's trading.

If this resistance breaks, meaning JBHT trades and holds above it, it will illustrate an important dynamic. It will mean that the sellers have either finished or canceled their orders. This could set the stage for a move higher because buyers will have to outbid each other to draw sellers into the market.

Savvy traders understand the importance of knowing where the recent opens, closes, highs, and lows have been. This allows them to profit.

Read Next:

Image: Shutterstock