In the last week, the United States market has stayed flat, although it has risen 5.7% over the past 12 months, with earnings expected to grow by 13% per annum in the coming years. In this context of moderate growth and stability, identifying small-cap stocks with notable insider activity can offer potential opportunities for investors seeking value in an evolving market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 9.5x | 2.1x | 15.88% | ★★★★★☆ |

| MVB Financial | 10.2x | 1.4x | 40.11% | ★★★★★☆ |

| S&T Bancorp | 10.1x | 3.5x | 46.32% | ★★★★★☆ |

| Flowco Holdings | 6.4x | 1.0x | 37.64% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 29.99% | ★★★★★☆ |

| Columbus McKinnon | 40.2x | 0.4x | 46.22% | ★★★☆☆☆ |

| PDF Solutions | 164.7x | 3.7x | 26.39% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -11.13% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3259.32% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -320.70% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

QCR Holdings (NasdaqGM:QCRH)

Simply Wall St Value Rating: ★★★★★★

Overview: QCR Holdings operates as a multi-bank holding company providing commercial banking services through its subsidiaries, with a market capitalization of approximately $1.48 billion.

Operations: QCR Holdings generates revenue primarily through its commercial banking operations, with significant contributions from Cedar Rapids Bank & Trust Company ($139.56 million) and Quad City Bank & Trust Company ($81.43 million). The company's net income margin has shown variability, reaching 35.18% in recent periods. Operating expenses are largely driven by general and administrative costs, which reached $177.01 million at the end of 2024.

PE: 9.9x

QCR Holdings, a small company in the U.S., showcases potential for investors seeking value. With earnings forecasted to grow 4.98% annually, it reflects steady growth prospects. Insider confidence is evident as leadership transitions are underway with Todd Gipple stepping up as CEO after Larry Helling's retirement post-May 2025 meeting. The company completed a share buyback of 745,000 shares for US$39.58 million by December 2024, signaling strategic capital allocation despite flat net income growth year-on-year at US$113.85 million in 2024.

- Get an in-depth perspective on QCR Holdings' performance by reading our valuation report here.

Gain insights into QCR Holdings' historical performance by reviewing our past performance report.

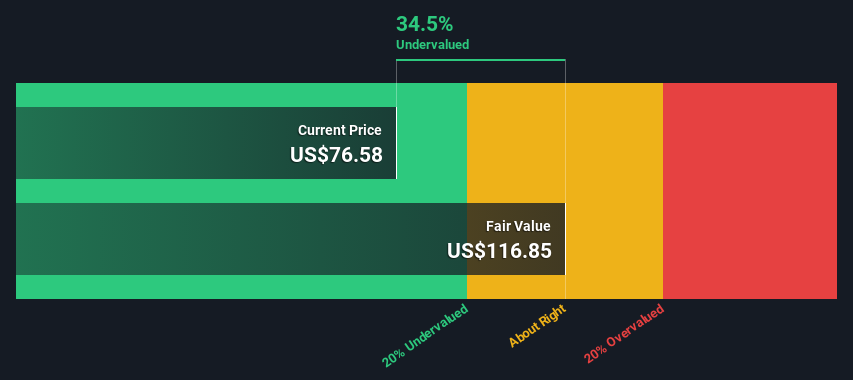

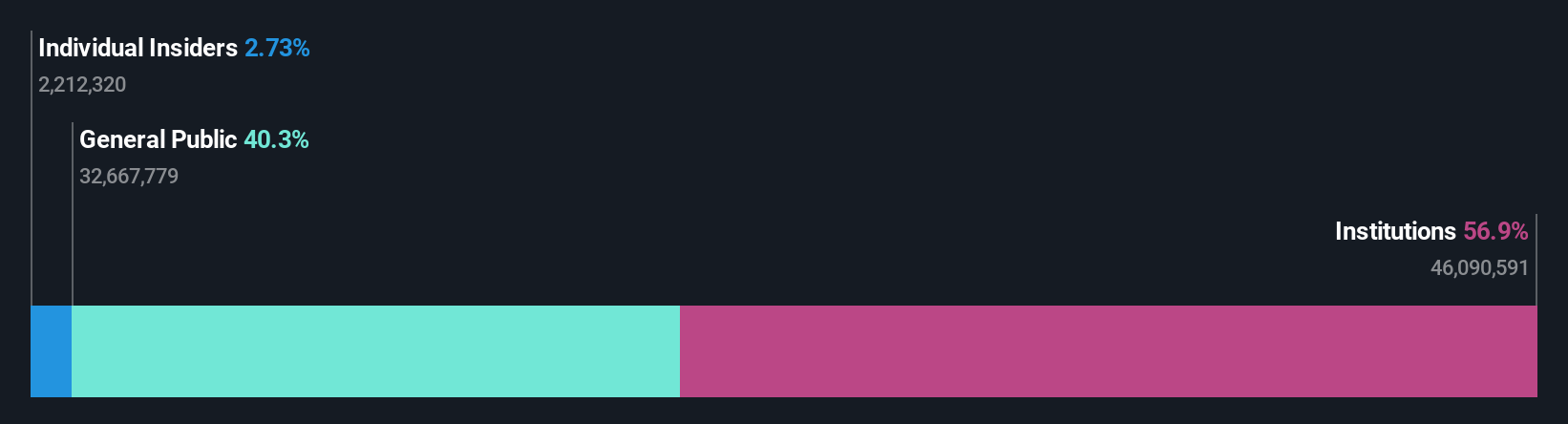

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing on a leveraged basis in a diversified portfolio of mortgage assets and has a market capitalization of approximately $1.48 billion.

Operations: The company's primary revenue stream is derived from investing in a diversified portfolio of mortgage assets, with recent quarterly revenues reaching $277.89 million. The cost of goods sold for the same period was $29.80 million, resulting in a gross profit margin of 89.28%. Operating expenses were reported at $64.89 million, contributing to a net income of $90.33 million and a net income margin of 32.51%.

PE: 10.2x

Chimera Investment, a smaller player in the U.S. market, recently reported a net income of US$176 million for 2024, up from US$126.1 million the previous year, with earnings per share increasing to US$1.12 from US$0.68. Despite its reliance on higher-risk external borrowing for funding and recent board changes, Chimera's forecasted 16.88% annual earnings growth suggests potential for future value appreciation. Notably, insider confidence is evident through recent share purchases within the last quarter, indicating belief in its prospects amidst industry challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Chimera Investment.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings is a diversified downstream energy company with operations in refining, logistics, and corporate segments, and it has a market cap of approximately $1.69 billion.

Operations: Delek US Holdings generates revenue primarily from its refining segment, contributing $11.78 billion, and logistics operations adding $940.6 million. The company's cost of goods sold (COGS) is a significant expense, impacting the gross profit margins which have experienced fluctuations over time, with recent figures showing a gross profit margin of 5.79%. Operating expenses include notable allocations for general and administrative costs and depreciation & amortization expenses.

PE: -1.2x

Delek US Holdings, a smaller player in the U.S. market, is navigating financial challenges with a reported net loss of US$560.4 million for 2024, contrasting with a previous net income of US$19.8 million. Despite these setbacks, insider confidence is evident as they continue to purchase shares, signaling potential optimism about future prospects. The company has completed significant share repurchases totaling 24.46% since November 2018 and maintains regular dividend payments at US$0.255 per share as of March 2025.

- Unlock comprehensive insights into our analysis of Delek US Holdings stock in this valuation report.

Where To Now?

- Investigate our full lineup of 82 Undervalued US Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com