Leidos Holdings (NYSE:LDOS) recently initiated a significant collaboration with the University of Pittsburgh, investing $10 million to advance AI applications in disease detection and management. This aligns with their longstanding commitment to health technology innovations. Meanwhile, the executive appointments of Daryle Lademan and Adam Clarke bring fresh leadership to their strategic and European operations, potentially stabilizing investor confidence. The successful flight test of the Black Arrow missile further underscores their advancements in the defense sector. These developments, while impactful, occur as the market remains flat in the short term with a 5.7% annual increase, leading to a flat stock performance last month.

Be aware that Leidos Holdings is showing 1 weakness in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments at Leidos Holdings, including the collaboration with the University of Pittsburgh and executive leadership changes, align closely with the company's NorthStar 2030 strategy. This strategy emphasizes IT modernization and increased privatization, which are poised to impact revenue positively in healthcare and defense sectors. The collaboration could enhance AI capabilities, potentially boosting revenues through new AI-driven offerings. Additionally, solidified leadership in strategic and European operations may bolster investor confidence, contributing to future earnings stability.

In a longer-term context, Leidos Holdings delivered a total return of 51.05% over the past five years, showcasing consistent growth despite recent flat stock performance. This compares favorably against the Professional Services industry's 7.4% one-year return. Such returns indicate resilience and a focus on transformation that has supported sustained growth. In the same year, Leidos outperformed the broader US market's 5.7% one-year return, demonstrating its relative strength amid competitive pressures.

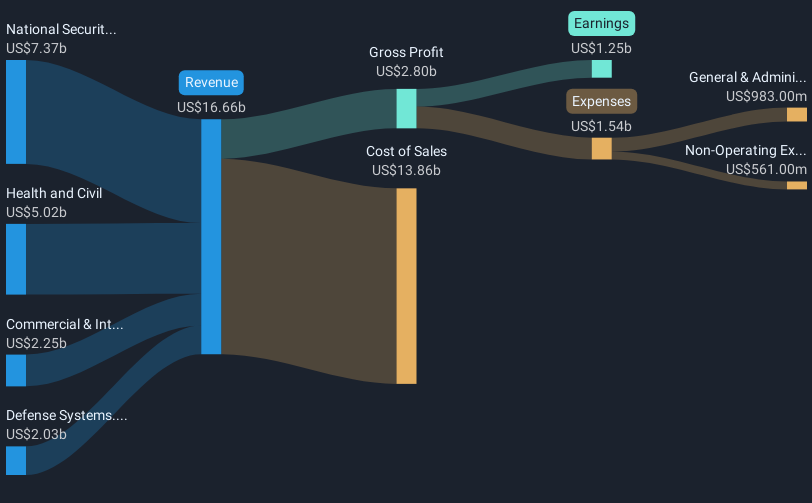

While the company faces potential competition and budgetary uncertainties, the successful test of defense technology and strategic share repurchases point to robust earnings forecasts supported by a strong contract backlog, including the notable $4.1 billion IFPC Enduring Shield contract. Current share price movements, with a 17.6% gap to the consensus price target of US$169.81, reflect market caution but also suggest potential upside if growth targets are achieved. Analysts' expectations hinge on Leidos meeting or exceeding projected revenue of $18.40 billion and earnings of $1.50 billion by 2028, essential metrics influencing future valuations and shareholder returns.

Learn about Leidos Holdings' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com