Consolidated Edison (NYSE:ED) recently affirmed a quarterly dividend of 85 cents per share, scheduled to be paid in June 2025. This announcement, coupled with a successful equity offering of 6.3 million shares raising $631 million, might have provided support to the company's stock, which saw a 20% increase over the last quarter. This gain was in line with the market's broader positive trend, up 6% over the past year. Despite a decrease in net income for the full year and fourth quarter of 2024, the dividend affirmation likely added confidence among investors during this period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over a five-year span, Consolidated Edison's total shareholder return, including stock price appreciation and dividends, was 64.85%, highlighting significant long-term growth. Despite specific annual metrics not being available for the full period, in the last year alone, ED outperformed both the US Integrated Utilities industry and the broader US market, which saw returns of 21.8% and 4.6%, respectively.

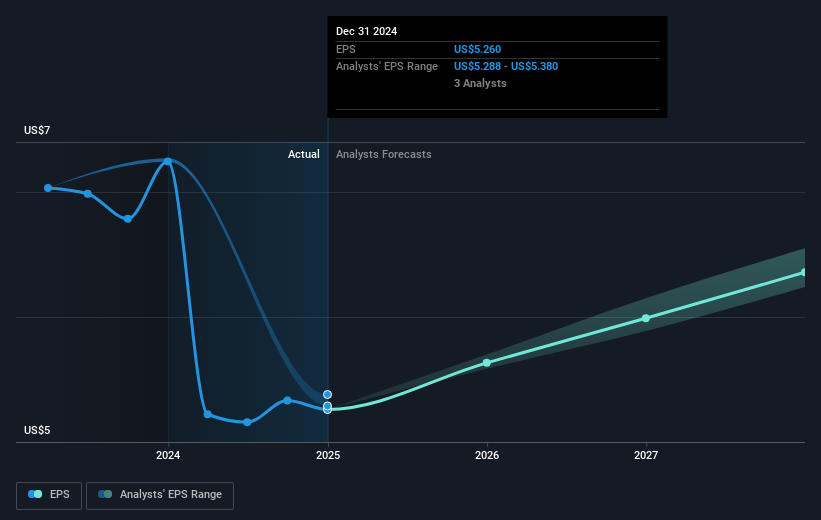

The recent dividend announcement and equity offering described in the introduction might positively influence revenue and earnings forecasts, with improved investor confidence potentially supporting future financial health. However, despite positive short-term share price movements, it's important to note that earnings per share have declined year-over-year, which could weigh on future profit expectations. With the current share price slightly below the consensus analyst price target of US$102.89, investors may deem the stock relatively attractive under current market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com