WEC Energy Group (NYSE:WEC) reaffirmed its commitment to shareholder value by announcing a quarterly dividend of 89 cents per share, payable on June 1, 2025, marking its 331st consecutive payout. The company also reported strong Q4 2024 earnings, with net income doubling to $453.5 million year-over-year. During the last quarter, WEC's share price increased by 9%, which aligns with the broader market's performance over the past year. This stability, supported by consistent dividend payments and positive earnings announcements, suggest that the company's actions complemented rather than drove the overall market trends.

The announcement of WEC Energy Group's quarterly dividend reinforces its dedication to delivering shareholder value, a critical factor in its long-term performance. Over the past year, the company achieved a substantial total return of 39.75%, a period that underscores WEC's capacity to leverage consistent and attractive dividends for shareholder returns. This performance surpasses the overall US market return of 4.6% and the 21.8% return of the US Integrated Utilities industry for the same year, highlighting WEC's robust position within its sector.

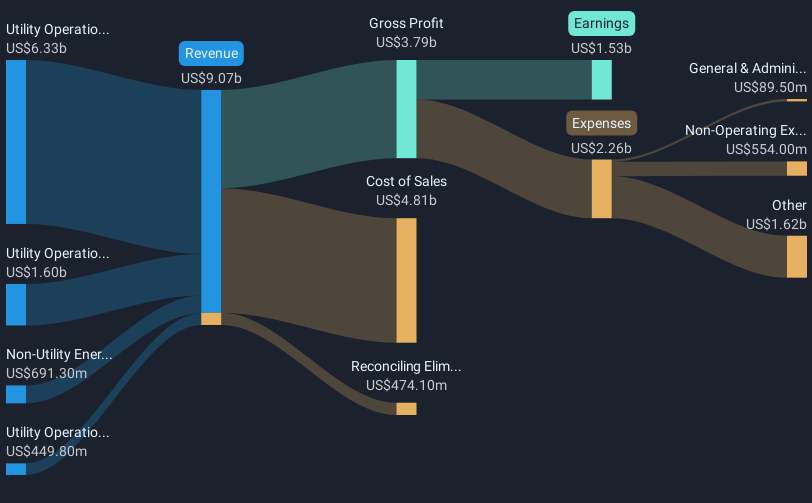

Looking ahead, the ongoing expansion in renewable energy and data centers could substantially impact revenue and earnings forecasts. Analysts currently predict a 6.6% annual revenue growth, reaching $10.4 billion by 2028, with earnings anticipated to grow to $2 billion. However, the ambitious $28 billion capital plan poses potential execution risks, such as cost overruns and regulatory hurdles, which could influence these forecasts.

Regarding share price movements, WEC's current share price of US$107.36 reflects a discount to the analyst consensus price target of US$104.77, indicating a 2.5% decline. This close proximity suggests that the market perceives WEC as fairly priced, despite ambitious growth plans and consistent dividend policy. As such, the continued focus on energy infrastructure expansion and favorable regulatory backdrop may further bolster investor confidence.

Learn about WEC Energy Group's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com