MP Materials (NYSE:MP) recently announced the appointment of David G. Infuso as Chief Accounting Officer, a move reflecting the company's focus on strengthening its financial leadership. While this leadership update is crucial, MP Materials' substantial 26% price increase over the last quarter aligns with broader market movement rather than singular company developments, as the overall market remained relatively flat. The company's production and financial performance, including record production levels and financial metrics, might have added support to this upward trajectory amidst the market's environment, but no standalone event drastically diverged its stock's path from the general market trend.

We've spotted 1 weakness for MP Materials you should be aware of.

Over the past year, MP Materials' total shareholder return, including share price and dividends, reached 60.09%. This performance contrasts with the broader market and the US Metals and Mining industry, which returned 5.7% and saw a 5.2% decline, respectively. These figures indicate MP Materials has significantly outperformed its industry peers in the same period.

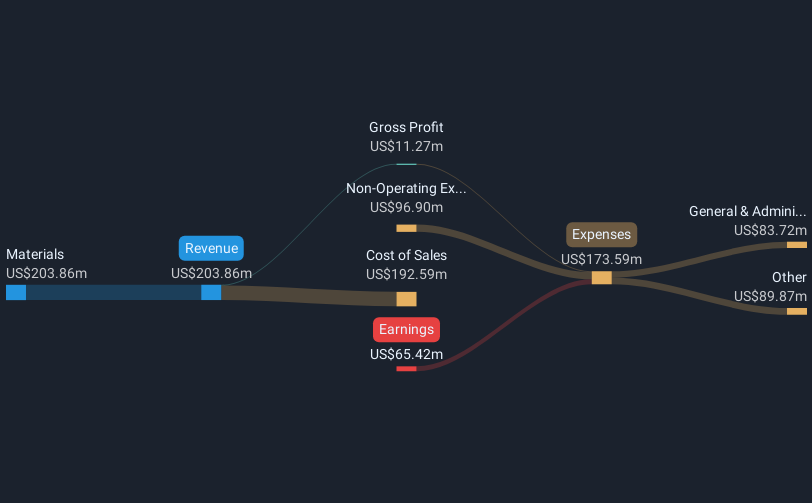

The company's recent executive appointments and strategic expansions, such as the commencement of commercial production at their Texas facility, could influence future revenue and earnings forecasts. Despite a decrease in annual sales from US$253.45 million to US$203.86 million, the company's projected revenue growth of 33.8% per year suggests an optimistic outlook. Analysts have pegged MP Materials' fair value price target at US$26.51. This indicates that the stock is trading close to this target, offering insights into its perceived market value. As the company continues to develop its production capabilities and enhance its financial management, these factors collectively support its robust annual performance amidst ongoing challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com