Top 2 Utilities Stocks That May Collapse This Month

Benzinga · 6d ago

Share

Listen to the news

As of April 21, 2025, two stocks in the utilities sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

National Grid Plc (NYSE:NGG)

- On Nov. 20, 2024, National Grid named Steve Smith as Chief Strategy and Regulation Officer. "It's a privilege to be appointed to this role at the most exciting time for the energy sector in decades," said Steve Smith "The strategy and regulation teams already deliver outstanding work to ensure National Grid is set up for success and that we continue to put our customers first. I am very much looking forward to continuing to build on this, as I take up the role on a permanent basis." The company's stock jumped around 13% over the past month and has a 52-week high of $73.40.

- RSI Value: 70.2

- NGG Price Action: Shares of National Grid gained 0.9% to close at $72.11 on Thursday.

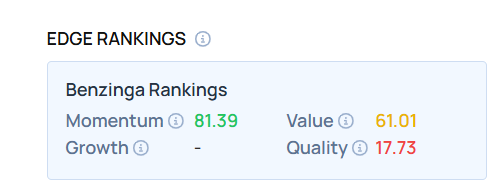

- Edge Stock Ratings: 81.39 Momentum score with Value at 61.01.

Korea Electric Power Corp (NYSE:KEP)

- The company's stock gained around 14% over the past month and has a 52-week high of $9.42.

- RSI Value: 71.9

- KEP Price Action: Shares of Korea Electric Power fell 0.1% to close at $8.58 on Thursday.

How do other stocks rank? Get the full BZ Edge Rankings breakdown here.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved