Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Option Care Health (NASDAQ:OPCH) in the last three months.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

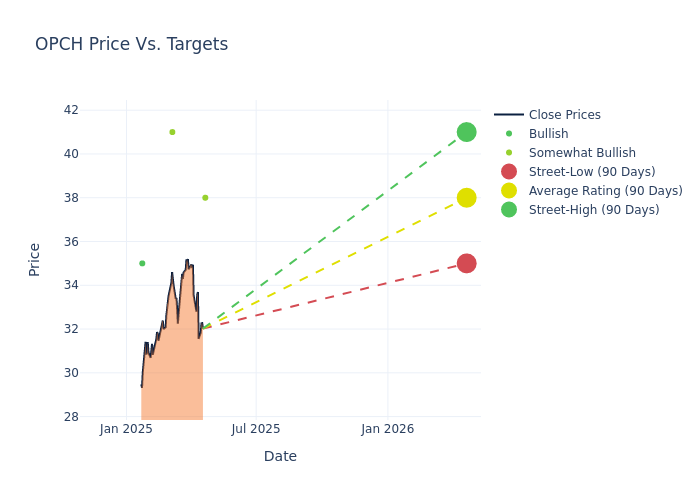

Analysts have set 12-month price targets for Option Care Health, revealing an average target of $38.4, a high estimate of $41.00, and a low estimate of $35.00. This current average has increased by 9.71% from the previous average price target of $35.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Option Care Health among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Michael Petusky |Barrington Research |Maintains |Outperform | $38.00|$38.00 | |Lisa Gill |JP Morgan |Raises |Overweight | $41.00|$40.00 | |Michael Petusky |Barrington Research |Raises |Outperform | $38.00|$33.00 | |Lisa Gill |JP Morgan |Raises |Overweight | $40.00|$38.00 | |Brian Tanquilut |Jefferies |Raises |Buy | $35.00|$26.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Option Care Health. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Option Care Health compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Option Care Health's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Option Care Health's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Option Care Health analyst ratings.

About Option Care Health

Option Care Health Inc is the provider of home and alternate-site infusion services. It provides treatment for bleeding disorders, neurological disorders, heart failure, anti-infectives, and chronic inflammatory disorders among others.

Breaking Down Option Care Health's Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Option Care Health's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 19.75%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Option Care Health's net margin is impressive, surpassing industry averages. With a net margin of 4.47%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Option Care Health's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.25%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Option Care Health's ROA stands out, surpassing industry averages. With an impressive ROA of 1.76%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Option Care Health's debt-to-equity ratio is below the industry average. With a ratio of 0.87, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.