7 analysts have shared their evaluations of AutoNation (NYSE:AN) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 4 | 0 | 0 |

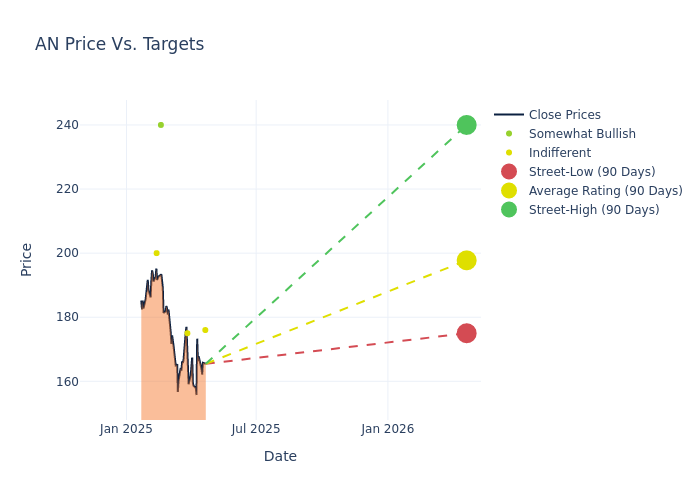

Analysts have set 12-month price targets for AutoNation, revealing an average target of $196.43, a high estimate of $240.00, and a low estimate of $175.00. Surpassing the previous average price target of $192.29, the current average has increased by 2.15%.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of AutoNation among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Colin Langan |Wells Fargo |Lowers |Equal-Weight | $176.00|$194.00 | |Rajat Gupta |JP Morgan |Lowers |Neutral | $175.00|$195.00 | |Rajat Gupta |JP Morgan |Raises |Neutral | $195.00|$180.00 | |Douglas Dutton |Evercore ISI Group |Raises |Outperform | $240.00|$220.00 | |Colin Langan |Wells Fargo |Raises |Equal-Weight | $194.00|$170.00 | |Jeff Lick |Stephens & Co. |Raises |Equal-Weight | $200.00|$195.00 | |Jeff Lick |Stephens & Co. |Raises |Equal-Weight | $195.00|$192.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to AutoNation. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of AutoNation compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of AutoNation's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into AutoNation's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on AutoNation analyst ratings.

Get to Know AutoNation Better

AutoNation is the second-largest automotive dealer in the United States, with 2024 revenue of about $27 billion and over 240 dealerships, plus 52 collision centers. The firm also has 26 AutoNation USA used-vehicle stores, a captive lender, four auction sites, and three parts distributors across 20 states primarily in Sunbelt metropolitan areas. New-vehicle sales account for nearly half of revenue; the company also sells used vehicles, parts, and repair services as well as auto financing. The company (formerly Republic Industries) divested its waste management unit (Republic Services) in 1999 and its car rental businesses (ANC Rental) in 2000. Wayne Huizenga founded the company in the 1990s to bring the rollup acquisition strategy to auto retailing, which has proved to be a smart move.

Unraveling the Financial Story of AutoNation

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: AutoNation's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 6.59%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: AutoNation's net margin excels beyond industry benchmarks, reaching 2.58%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): AutoNation's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.71%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): AutoNation's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.44% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: AutoNation's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 3.52.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.