Motorola Solutions (NYSE:MSI) recently launched the SVX, a revolutionary video remote speaker microphone, and introduced Assist, emphasizing the company's focus on integrating AI to enhance public safety technology. While these product innovations demonstrate the company's commitment to advancing first responder capabilities, they did not significantly alter the company's share price, which remained flat over the past month. Broader market dynamics, such as falling U.S. stock indexes amidst tariff concerns and central bank criticism, were more influential in the minor overall movement of Motorola's stock, consistent with wider trends affecting tech stocks during this period.

You should learn about the 2 weaknesses we've spotted with Motorola Solutions.

Motorola Solutions' introduction of the SVX and Assist underscores its commitment to advancing public safety technology, though these innovations had a negligible effect on its share price amidst broader market concerns. Over the past five years, the company's shares delivered a total return of 191.07%, reflecting strong long-term performance. This contrasts with the past year's return where Motorola Solutions outperformed the US Communications industry, which saw a return of 19.5%.

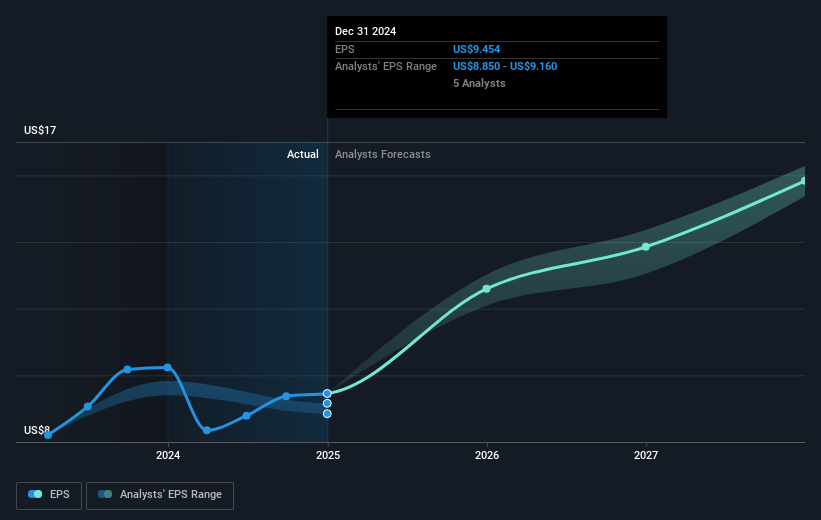

The company's recent acquisitions and product developments could potentially enhance its revenue and earnings forecasts. With robust demand for its solutions and a record backlog of $14.7 billion, Motorola Solutions is well-positioned for ongoing revenue growth. Analysts anticipate a 5.8% annual revenue increase over the next three years, supported by cloud adoption and SaaS offerings. However, potential challenges such as geopolitical issues and unfavorable foreign currency effects could impact this forecast.

Currently, Motorola Solutions' share price is US$420.45, which is approximately 15.5% below the consensus analyst price target of US$497.33. This price target considers projected earnings growth and requires an assumption of a future price-to-earnings ratio of 38.6x, down from the current 44.6x. Investors should critically evaluate these forecasts given market conditions and inherent risks.

Our valuation report unveils the possibility Motorola Solutions' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com