XPeng (NYSE:XPEV) recently unveiled its innovative AI Tech Tree and launched its flagship vehicle, the 2025 XPENG X9, highlighting major advancements in AI and charging technology. This technological focus aligns with XPeng's expansion into new markets like Poland, further underscoring its strategic global growth. Despite concerns from broader markets affected by trade tensions and tariffs, XPeng reported a quarterly price increase of 21.47%. The company's strong sales performance and technological innovations likely provided a counterweight to the challenging market conditions, fostering investor confidence despite the market's broader decline.

We've discovered 1 weakness for XPeng that you should be aware of before investing here.

The recent unveiling of XPeng's AI Tech Tree and the launch of the XPENG X9 suggest a focus on technological advancement that may bolster long-term growth through enhanced vehicle capabilities. These innovations could drive revenue growth by capturing broader market appeal and potentially increasing vehicle sales. Despite the short-term challenges posed by such investments, these efforts align with XPeng's strategy to fortify its position in the global market, which can enhance future earnings and margin improvements.

Over the past year, XPeng's total shareholder return, including share price and dividends, surged by a very large percentage. Comparatively, XPeng outperformed both the US market, which delivered a 5.9% return in the past year, and the US Auto industry, which delivered a 46.4% return. The company's robust performance in recent months, including a quarterly share price increase, underscores investor optimism regarding its growth trajectory.

The consensus price target stands at $19.91, lower than XPeng's current share price of $22.64, suggesting potential overvaluation relative to analyst expectations. This discrepancy may reflect differing opinions on future profitability and revenue growth prospects, given the company's significant investments in AI and international expansion. As such, XPeng's future success depends heavily on executing these plans effectively, balancing increased R&D and expansion expenditures with resultant revenue and earnings growth.

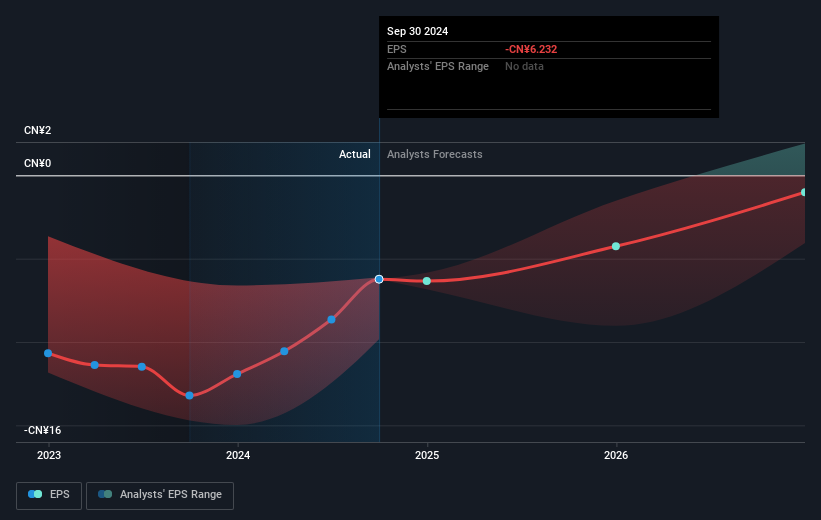

Evaluate XPeng's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com