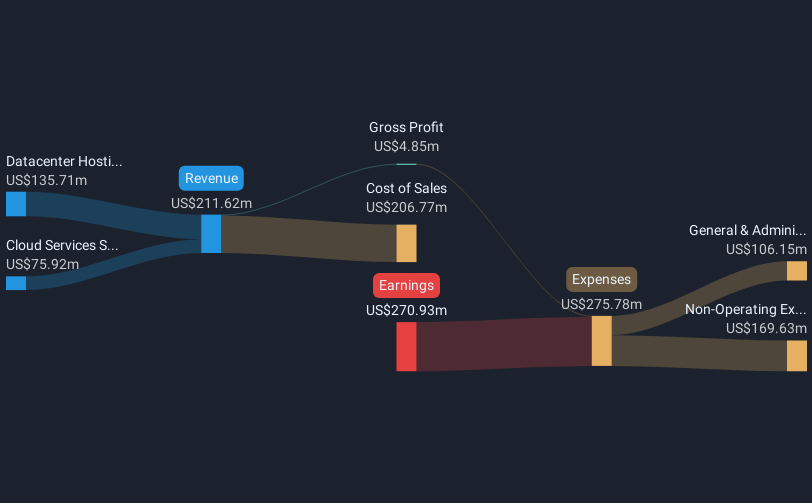

Applied Digital (NasdaqGS:APLD) experienced a 26% decline in its stock price last week, following the announcement of its third-quarter results. The company reported increased sales revenue but still endured a significant net loss. This performance came amidst a broader market decline of 1.1%, influenced by concerns over U.S.-China tariffs and fluctuating economic policies. While Applied Digital's financial improvements show progress, the ongoing challenges in reducing losses likely intensified investor caution. These corporate results added weight to the broader market sell-off, as investors remain wary of economic uncertainties and the company's path to profitability in the tech sector.

The recent announcement of Applied Digital's third-quarter results has generated significant attention, particularly as the company witnessed a decline in its stock price by 26% last week. Despite increased sales revenue, the persistently high net loss has raised concerns over the company's current financial health and growth prospects. This news could potentially affect the revenue and earnings forecasts, as evidenced by the company's ongoing transition strategies, like its transition to a data center REIT structure and strategic partnerships. These initiatives might address some financial challenges, but the timeline and effectiveness of these efforts remain uncertain under current market conditions.

Over the past five years, Applied Digital's shares have demonstrated an astounding total return of a very large percentage. This remarkable performance, although impressive over the long term, contrasts with the more recent stock movement over the last year, during which it exceeded the US IT industry return of 5.9%. Despite the recent volatility, this longer-term performance highlights the company's potential when previous challenges were adequately managed.

Given the current share price of US$4.08, the drop reflects a notable discount to the analyst consensus price target of US$10.06. The potential improvements in revenue, driven by strategic partnerships and REIT transition plans, need to materialize to meet or surpass this target. Analysts expect substantial growth, forecasting revenue growth of 37.9% annually over the next three years, but the current share price suggests market skepticism around achieving these targets within the expected timeframe. As such, the company's future trajectory remains closely linked to the successful implementation of its outlined strategic shifts.

Our expertly prepared valuation report Applied Digital implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com