In the last three months, 5 analysts have published ratings on Kimbell Royalty Partners (NYSE:KRP), offering a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 1 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

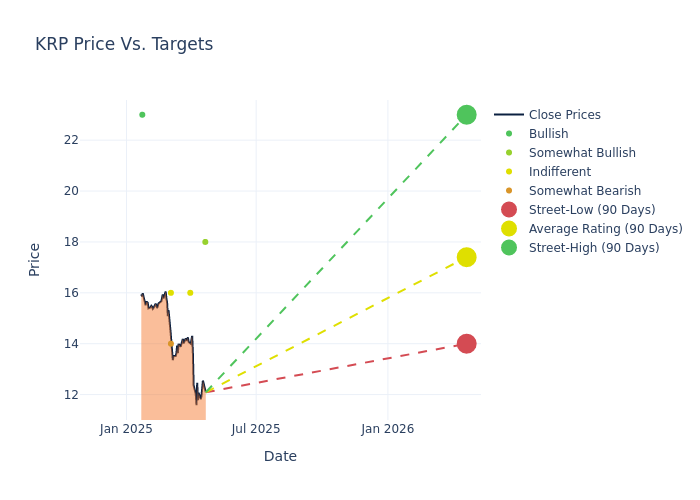

The 12-month price targets, analyzed by analysts, offer insights with an average target of $17.4, a high estimate of $23.00, and a low estimate of $14.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 9.61%.

Decoding Analyst Ratings: A Detailed Look

The perception of Kimbell Royalty Partners by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Tim Rezvan |Keybanc |Lowers |Overweight | $18.00|$20.00 | |William Janela |Mizuho |Announces |Neutral | $16.00|- | |Neal Dingmann |Truist Securities |Lowers |Hold | $16.00|$22.00 | |Noah Hungness |B of A Securities |Lowers |Underperform | $14.00|$16.00 | |John Freeman |Raymond James |Raises |Strong Buy | $23.00|$19.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kimbell Royalty Partners. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Kimbell Royalty Partners compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Kimbell Royalty Partners's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Kimbell Royalty Partners's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Kimbell Royalty Partners analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Kimbell Royalty Partners

Kimbell Royalty Partners LP owns and acquires mineral and royalty interests in oil and natural gas properties throughout the United States. The company's basins and producing regions include areas of interest in the Permian Basin, Mid-Continent, Terryville/Cotton Valley/Haynesville, Appalachian Basin, Eagle Ford, Bakken/Williston Basin, and DJ Basin/Rockies/Niobrara. Its revenues are derived from royalty payments received from operators based on the sale of oil, natural gas and NGL production, as well as the sale of NGLs that are extracted from natural gas during processing.

Kimbell Royalty Partners: A Financial Overview

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Kimbell Royalty Partners's financials over 3M reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -16.16% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -53.33%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -4.64%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Kimbell Royalty Partners's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -3.24%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.31.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.