The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies PENN Entertainment, Inc. (NASDAQ:PENN) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is PENN Entertainment's Net Debt?

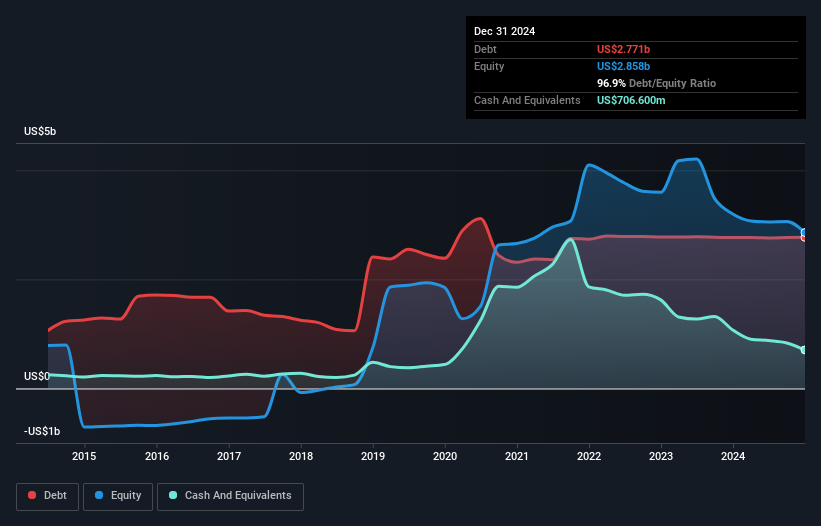

As you can see below, PENN Entertainment had US$2.77b of debt, at December 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had US$706.6m in cash, and so its net debt is US$2.06b.

A Look At PENN Entertainment's Liabilities

According to the last reported balance sheet, PENN Entertainment had liabilities of US$1.42b due within 12 months, and liabilities of US$11.0b due beyond 12 months. Offsetting this, it had US$706.6m in cash and US$249.6m in receivables that were due within 12 months. So its liabilities total US$11.4b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$2.11b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, PENN Entertainment would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for PENN Entertainment

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about PENN Entertainment's net debt to EBITDA ratio of 3.5, we think its super-low interest cover of 0.36 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, PENN Entertainment's EBIT was down 58% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine PENN Entertainment's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, PENN Entertainment recorded free cash flow of 30% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, PENN Entertainment's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its net debt to EBITDA also fails to instill confidence. Taking into account all the aforementioned factors, it looks like PENN Entertainment has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given our concerns about PENN Entertainment's debt levels, it seems only prudent to check if insiders have been ditching the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.